Introduction

Web3 & Blockchain Consultancy :

Exploring The Impact of Security Tokens on the Financial World

In the cryptocurrency domain, security tokens have emerged as a groundbreaking innovation that combines the benefits of blockchain technology with traditional finance. These digital assets represent ownership or claims to real-world valuable assets, which are tokenized and securely stored on the blockchain.Key Takeaways

- What are Security Tokens: Security tokens are digital assets that represent ownership or rights to real-world assets, leveraging blockchain technology to provide transparency, efficiency, and regulatory compliance. They offer investors access to traditional investment instruments like stocks, bonds, and real estate in a tokenized format.

- Security Tokens vs. Utility Tokens: Security tokens represent ownership rights or claims to real-world assets, while utility tokens provide access to specific services within a project’s ecosystem.

- Types of Security Tokens: Security tokens can be categorized into three main types: equity tokens, asset-backed tokens, and debt tokens, each offering distinct features and benefits.

- Market Access and Innovation: Security tokens open up new investment opportunities, provide greater market access, and foster innovation in financial instruments through programmable contracts and shared ledgers.

What is a Security Token?

A security token is a digital asset that represents ownership or rights to an underlying asset, which has been tokenized and recorded on a blockchain. The process of tokenization involves transferring an asset’s ownership to the blockchain, where it is assigned a unique identifier through a hashing algorithm. This digital token then serves as the representation of the underlying asset, which could be anything from stocks and bonds to other securitized assets. The concept of tokenization is not entirely new; in traditional finance, companies used to issue physical stock certificates to investors, representing ownership or rights. Security tokens are basically the digital version of traditional investments. They bring blockchain benefits like transparency, unchangeable records, and efficiency to the world of securities.Understanding Tokenization

To understand security tokens, you first need to grasp what tokenization is. Tokenization means converting the ownership of an asset, whether it’s a company or a physical item like a car, into a digital token on the blockchain. This token represents ownership and can be bought, sold, and transferred just like any other digital asset. For instance, think about tokenizing a car. The car’s identification number (VIN) and the owner’s details can be turned into a digital token and stored on the blockchain. This digital token then represents ownership and can be traded, making it possible to transfer the car’s ownership. Similarly, security tokens stand for ownership or rights to assets. But instead of physical assets, they usually represent assets like stocks, bonds, or other financial investments.3 Types of Security Tokens

Security tokens can be categorized into three types:Equity Tokens

Equity tokens are digital versions of company stocks. These tokens give buyers dividends, ownership, and voting rights. Startups can raise funds by offering equity tokens to the public, making it easier for individual investors to invest in new companies.Asset-Backed Tokens

Asset-backed tokens represent ownership of real-world assets like gold, fine art, or real estate. The value of these tokens is based on the value of the underlying asset. For example, if you prefer investing in commodities, you can buy tokens that represent assets like silver or gold.Debt Tokens

Debt tokens work like short-term loans to an entity. In return, the token holder gets interest payments, similar to dividends. The amount of dividends paid depends on the risk involved. Lenders and borrowers agree on the terms for the dividend payout rate and duration.How Do Security Tokens Differ from Utility Tokens?

Although utility tokens can change in value and are sometimes used for investment, they are fundamentally different from security tokens. The following table highlights the key differences between these two types of tokens:| Parameters | Security Tokens | Utility Tokens |

| Purpose | Backed by tangible assets such as real estate, company shares, or bonds. | Provide access to specific services or products within a project’s ecosystem, typically used for paying fees and accessing features. |

| Ownership | Grant legal rights over real-world assets, often including profit-sharing and voting rights. | Typically do not provide ownership rights over physical assets. |

| Regulations | Subject to stringent legal regulations when offering STOs, which enhances their security. | Often lack regulation, making ICOs/IDOs less secure compared to STOs. |

| Market Liquidity | Often have lower liquidity because of regulatory constraints and the characteristics of the underlying assets. | Generally have higher liquidity, making them easier to trade on different exchanges. |

| Investor Profile | Draws in traditional investors and individuals seeking assets with real-world value and legal protections. | Attracts individuals focused on specific blockchain projects and the functional benefits those projects offer. |

| Risk Profile | Typically viewed as a lower risk because of regulatory supervision and backing by tangible assets, though asset performance remains a factor. | Regarded as a higher risk due to the absence of regulation and dependence on the project’s success and user adoption. |

| Usage | Mainly employed for investment objectives and as a digital portrayal of ownership in an asset. | Utilized within a particular ecosystem for tasks such as accessing services, participating in project decisions, or as a means of transaction. |

| Compliance Needs | Mandates compliance with securities regulations, encompassing KYC and AML protocols. | Features more relaxed compliance standards, though this may differ depending on jurisdiction and token attributes. |

How Do Security Tokens Differ from Cryptocurrencies?

Security tokens and cryptocurrencies might both be digital assets on a blockchain, but they have different purposes. Cryptocurrencies like Bitcoin and Ethereum are made to be used as decentralized currencies or for payments. They do not represent ownership or rights to underlying assets. In contrast, security tokens are created to signify ownership or rights to assets, similar to traditional investments like stocks and bonds. Unlike cryptocurrencies, security tokens must follow regulatory rules and are subject to securities laws.Benefits of Security Tokens

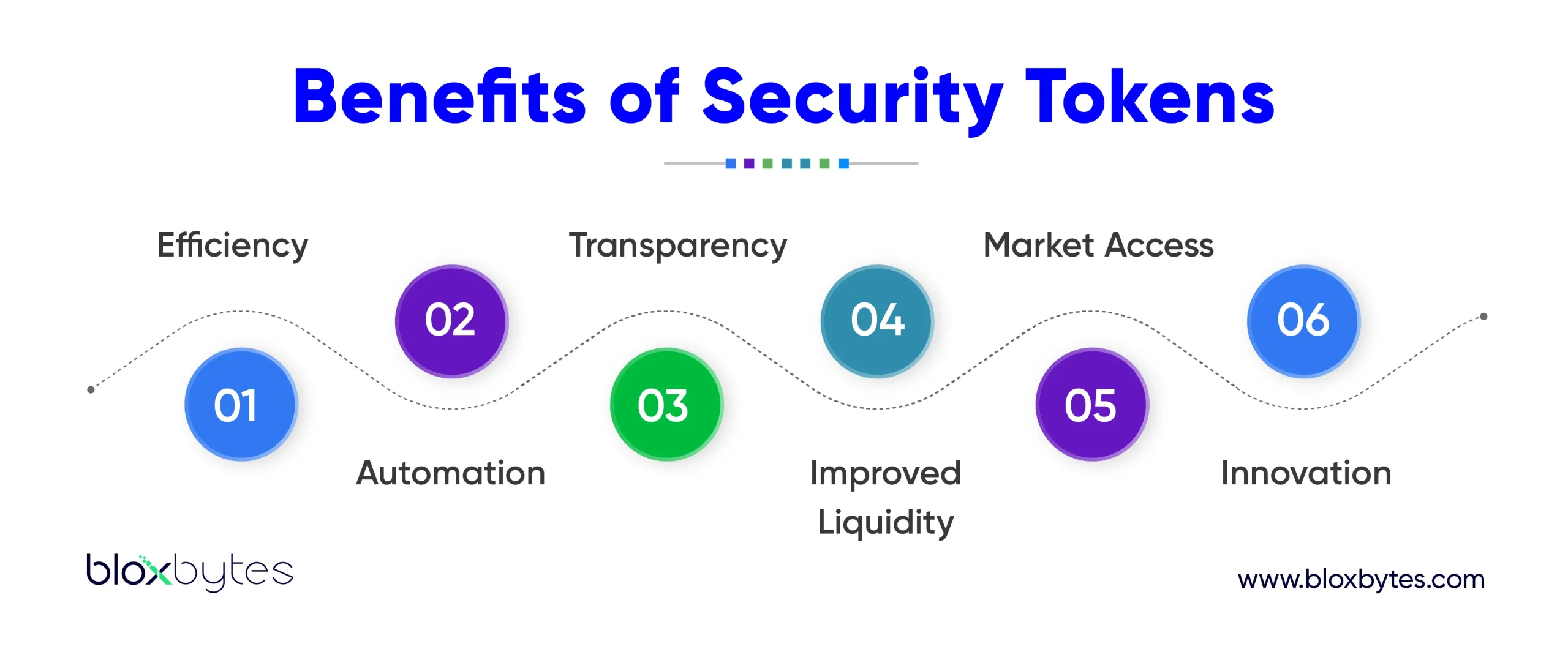

Security tokens offer many advantages over traditional securities, bringing new ideas and efficiency to investments:

Efficiency

Tokenization removes the need for middlemen, making fundraising and trading processes smoother. This results in faster transactions, shorter settlement times, and lower costs. Things like dividend payments, voting rights, and liquidation preferences can be automated, saving time and resources.Automation

Using smart contracts and programmable rules, security tokens can ensure better compliance with regulations. Compliance rules can be built into the token itself, making sure that regulatory requirements are met automatically. Payments like dividends can also be automated, boosting efficiency and transparency.Transparency

Blockchain technology provides a clear and unchangeable record of ownership and transactions. This transparency reduces disputes, protects investors, and prevents fraud like document tampering. Investors can trust the accuracy and reliability of the information on the blockchain.Improved Liquidity

One of the biggest benefits of security tokens is their ability to increase liquidity in markets that are usually illiquid. Tokenizing assets allows for fractional ownership and lets investors from around the world participate. Assets that were once hard to access or sell become more available, leading to higher liquidity and potential market growth.Market Access

Security tokens create new investment opportunities and help investors diversify their portfolios. With security tokens, investors can access assets that were previously unavailable or hard to reach. The blockchain operates 24/7, allowing investors to trade anytime, without being limited by weekends, holidays, or bank hours.Innovation

Security tokens open the door to innovative financial products. Contracts that can be programmed along with shared ledgers enable the creation of fractionalized real estate, dynamic exchange-traded funds (ETFs), revenue-sharing agreements, and more. The potential for innovation in the digital asset space is vast and always growing.Security Tokens and Regulations

Security tokens must follow rules set by financial authorities to protect investors and keep the market fair. In the United States, the Securities and Exchange Commission (SEC) oversees security tokens. The SEC uses the “Howey Test” to decide if a token is a security. A token is considered a security if it meets these criteria under the Howey Test: there is an investment of money, a common enterprise, and an expectation of profits from the efforts of others. Following these rules is essential to protect investors and keep the market stable.Investing in Security Tokens

Security tokens are not yet widely available to retail investors on public stock or cryptocurrency exchanges. Many institutions are working to get regulatory approval to make security tokens more accessible to a wider range of investors. Until then, investing in security tokens might be limited to accredited investors or large institutions. It’s important to remember that investing in security tokens carries risks, just like any other investment. Investors should do thorough research, check the credibility of the issuing company, and seek professional advice before making any investment decisions.Frequently Ask Questions

What is your understanding of standard security tokens?

Standard security tokens are digital representations of ownership or rights to real-world assets, such as stocks, bonds, or real estate. These tokens are issued and managed on a blockchain, providing investors with a secure and transparent way to access traditional investment opportunities in a digital format.How does a security token work?

A security token works by tokenizing ownership or rights to real-world assets and recording them on a blockchain. When an investor purchases a security token, they receive a digital certificate representing their ownership stake. This ownership is recorded and verified on the blockchain, providing transparency and security.What are examples of a security token?

Examples of security tokens include tokenized stocks, where shares of publicly traded companies are represented digitally on a blockchain, allowing investors to buy and sell fractional ownership stakes. Another example is tokenized real estate, where ownership of properties is represented by digital tokens, enabling investors to access real estate investment opportunities with lower entry barriers.Why are security tokens important?

Security tokens are important for several reasons:- Democratize access to investments.

- Boost liquidity in markets.

- Enhance transparency and security.

- Streamline processes with automation.

- Ensure regulatory compliance.