Introduction

Blockchain & Web3 Services Trusted By Leaders

- Develop innovative solutions using our state-of-the-art blockchain expertise.

- Achieve accelerated growth with robust & scalable Web3 consulting.

- Unlock 360-degree security with our top-rated blockchain development.

Transforming Asset Management With Blockchain Integration

Blockchain has emerged as a significant force in digital asset management, reshaping how assets are managed, tracked, and valued across various industries. This technology introduces a decentralized and secure framework, fundamentally changing traditional processes. At its core, blockchain utilizes a transparent, immutable ledger for recording transactions securely and without intermediaries. This feature greatly improves the security and transparency of digital assets, substantially lowering the risk of fraud and mismanagement. Asset management on a blockchain means streamlining operations and reducing costs associated with traditional systems. For example, in real estate, it can speed up property transactions by securely logging ownership and historical data, eliminating lengthy verification processes and reducing the likelihood of disputes. Meanwhile, in the art industry, the ability of blockchain to authenticate the provenance of artworks instills confidence in buyers, fostering a more transparent and trustworthy market.Key Takeaways

- Blockchain Integration in Asset Management: Blockchain technology enhances transparency and security by providing a decentralized and immutable ledger for all asset transactions. It increases efficiency and reduces costs by eliminating intermediaries and enabling faster transactions.

- What Are Digital Assets? – Digital assets encompass a range of digitized items, including cryptocurrencies, tokens, digital rights, and digital versions of physical assets.

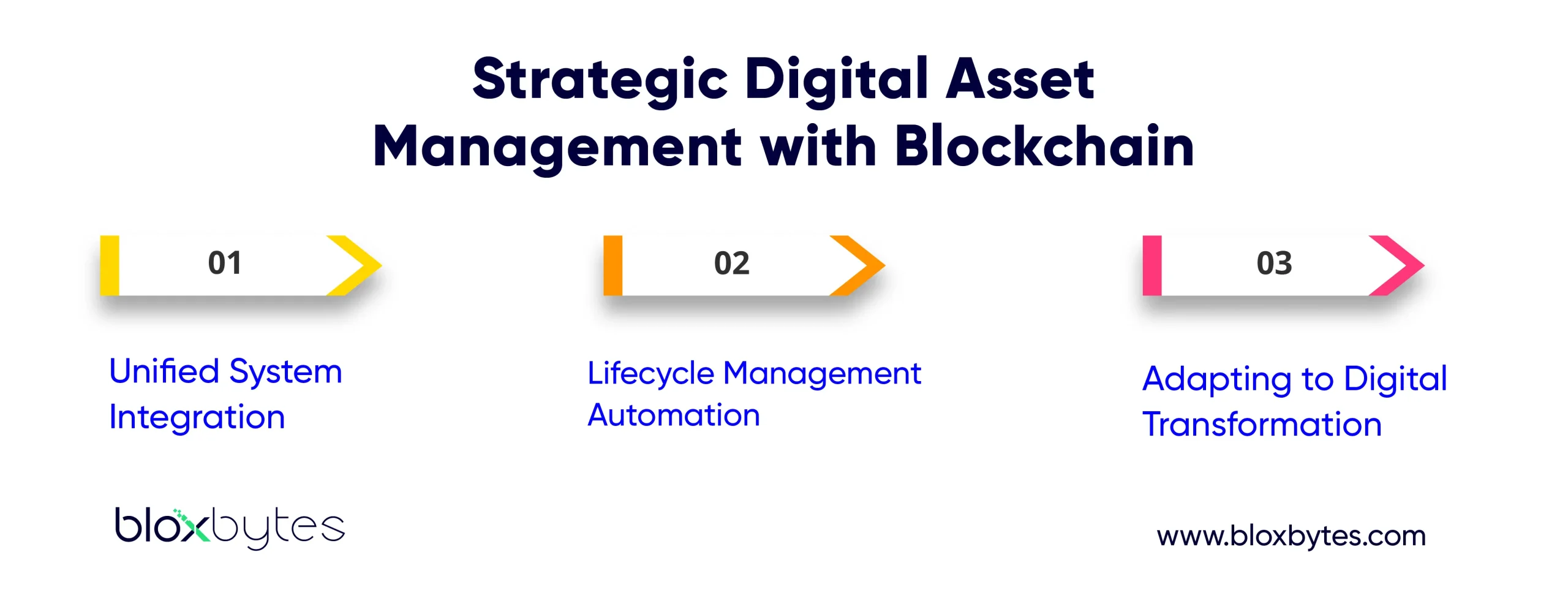

- Strategic Digital Asset Management: Integrating blockchain into digital asset management strategies allows businesses to achieve unprecedented levels of security, efficiency, and transparency. This approach supports the seamless integration of various digital assets into a unified system.

- Future Trends in Asset Management: We can expect more efficient and secure systems that democratize access to digital assets, fostering a more inclusive global economy driven by fairness, efficiency, and innovation.

Understanding Digital Assets and Blockchain Integration

As we dive deeper into the transformative impact of blockchain technology on digital asset management, it’s crucial to understand what constitutes a digital asset within the blockchain framework and how this integration enhances asset security and transparency. Digital assets in this context include anything digitized and integrated into a blockchain system, ranging from cryptocurrencies and tokens to digital rights, intellectual property, and even digital versions of physical assets.What Are Digital Assets?

Digital assets are essentially any asset that has been digitized and incorporated into a blockchain system. These can include a wide variety of assets, such as cryptocurrencies, tokens, digital rights, intellectual property, and digital versions of physical assets like real estate. This broad range of digital assets benefits from the unique properties of blockchain technology.Security and Transparency

The integration of blockchain technology with digital assets addresses many traditional issues in digital asset management, including security breaches, unauthorized access, and lack of transparency. Blockchain’s decentralized nature, immutable ledger, and consensus-driven validation process ensure that every transaction or modification of an asset is securely recorded and verifiable by all parties involved. This not only boosts the security of digital assets but also their transparency, since every transaction is visible and immutable once confirmed. Consider the issue of digital art piracy, where artworks are copied and distributed without consent. Blockchain technology can combat this by creating a unique, immutable digital certificate for each piece of art, tracking ownership and provenance throughout its lifecycle. This ensures a clear and traceable lineage of ownership, upholding the rights of the original creators and building trust among buyers and sellers.Increasing Efficiency Through Automation

Integrating blockchain into digital asset management systems significantly enhances their efficiency. Blockchain automates processes such as verification, settlement, and compliance through smart contracts, reducing the need for manual intervention that often leads to delays and errors. This automation extends to real-time updates and access to asset records, which is particularly beneficial in sectors like finance where quick and accurate information is crucial. The fusion of asset management on the blockchain not only addresses key challenges but also opens new avenues for innovation and efficiency. As this technology continues to evolve, it is clear that blockchain is set to redefine the norms of digital asset management, making it more secure, transparent, and efficient.The Value Blockchain Offers for Asset Holders

Blockchain technology is transforming how asset holders manage and interact with their investments. It offers unprecedented liquidity and accessibility while simultaneously reducing risks and building trust. Central to this transformation is blockchain’s capability to facilitate faster, more efficient transactions without relying on traditional intermediaries like banks or brokers. This not only speeds up the process but also significantly lowers transaction costs, making it easier and more economical for investors to buy, sell, and trade assets.Enhanced Transaction Efficiency and Lower Costs

A prime example of blockchain’s impact is seen in the real estate sector. Traditionally, buying and selling property involves numerous steps, including multiple verifications, that can take weeks or even months to complete. Blockchain offers a simplified method where property titles are tokenized – transformed into digital tokens on the blockchain. These tokens signify ownership and can be exchanged similarly to stocks on an exchange. This asset tokenization on a blockchain process not only speeds up transactions but also opens the market to smaller investors who can now afford to buy fractions of properties, enhancing liquidity and market participation.Increased Security and Trust

Blockchain inherently increases the security and trust in transactions. Each transaction is recorded on a decentralized ledger, visible to all parties, and immutable once entered, which virtually eliminates the risk of fraud and unauthorized manipulation. For asset owners, this translates to a lower risk of asset theft and increased confidence in the security of their investments. For instance, in the art world, blockchain can provide a verifiable history of an artwork’s ownership, authenticity, and provenance, reducing the risk associated with buying and selling high-value art pieces.Improved Accessibility and Market Participation

Asset management on blockchain also extends to enhancing accessibility. By democratizing access to investment opportunities, blockchain allows people from various economic backgrounds to participate in markets from which they were traditionally excluded. This is particularly transformative in developing regions, where access to investment opportunities can be limited. Blockchain platforms enable individuals to invest in small increments, making it feasible for more people to build investment portfolios despite having limited capital. Blockchain technology revolutionizes the operational aspects of asset management and fundamentally changes the relationship between asset holders and their investments. By enhancing liquidity, reducing risks, and increasing trust and accessibility, blockchain is setting a new standard for how assets are managed in the digital age. As this technology develops further, there is enormous and promising potential for further innovation and enhancement in asset management.Asset Tokenization Z – A Case Study

The concept of asset tokenization on blockchain is transforming the way we perceive and manage ownership and trading of assets. The Tokenization Z Model is a pioneering framework applied across various sectors, demonstrating the practical benefits of integrating blockchain technology into traditional asset management systems. This model converts physical and digital assets into blockchain-based tokens, enabling more fluid and accessible transactions.Real Estate Transformation

In the real estate sector, the Tokenization Z Model has been instrumental in revolutionizing property ownership. Traditionally, buying or selling property involves a cumbersome process with numerous regulatory hurdles and high entry costs, which often discourage small investors. Tokenizing real estate breaks down properties into smaller, more affordable digital shares that can be bought and sold on blockchain platforms. This democratizes access to real estate investments and enhances liquidity, allowing for quicker and more frequent transactions without the need for extensive paperwork or intermediaries.Fine Art and Collectibles

The Tokenization Z Model also shows significant promise in the fine art world. Art asset tokenization on a blockchain offers artists and collectors new methods to secure and manage ownership. Each artwork can be tokenized into digital shares, with its provenance and ownership history securely recorded on the blockchain. This system addresses common issues like forgery and unauthorized sales, creating a more transparent and trustworthy market.Broader Applications and Benefits

Implementing the Tokenization Z Framework yields numerous practical benefits. For example, in the realm of collectibles, tokenization has enabled partial ownership and trading of rare items previously out of reach for average collectors. Additionally, the increased transparency and security provided by blockchain reduce fraud and enhance trust among buyers and sellers. The Tokenization Z Model exemplifies how blockchain can be creatively applied to address traditional problems in asset management. It offers a glimpse into a future where digital and physical assets are more accessible, secure, and liquid. This case study not only highlights the practical applications of blockchain technology but also underscores its potential to transform industries by making asset ownership more inclusive and efficient.Strategic Digital Asset Management with Blockchain

Blockchain technology goes beyond being a supportive tool; it is a strategic asset that can fundamentally transform how companies manage and leverage their digital resources. By integrating blockchain into their digital strategies, businesses can achieve unprecedented levels of security, efficiency, and transparency, leading to a more comprehensive and agile asset management approach. Consider a multinational corporation handling vast amounts of sensitive data across various geographies. By incorporating blockchain into their digital asset management systems, every transaction, access, and modification can be recorded on a decentralized ledger. This ensures data security against unauthorized access and cyber threats, while also providing a transparent audit trail invaluable for regulatory compliance and quality assurance.