Introduction

Blockchain & Web3 Services Trusted By Leaders

- Develop innovative solutions using our state-of-the-art blockchain expertise.

- Achieve accelerated growth with robust & scalable Web3 consulting.

- Unlock 360-degree security with our top-rated blockchain development.

Flow Blockchain: Things You Need to Know

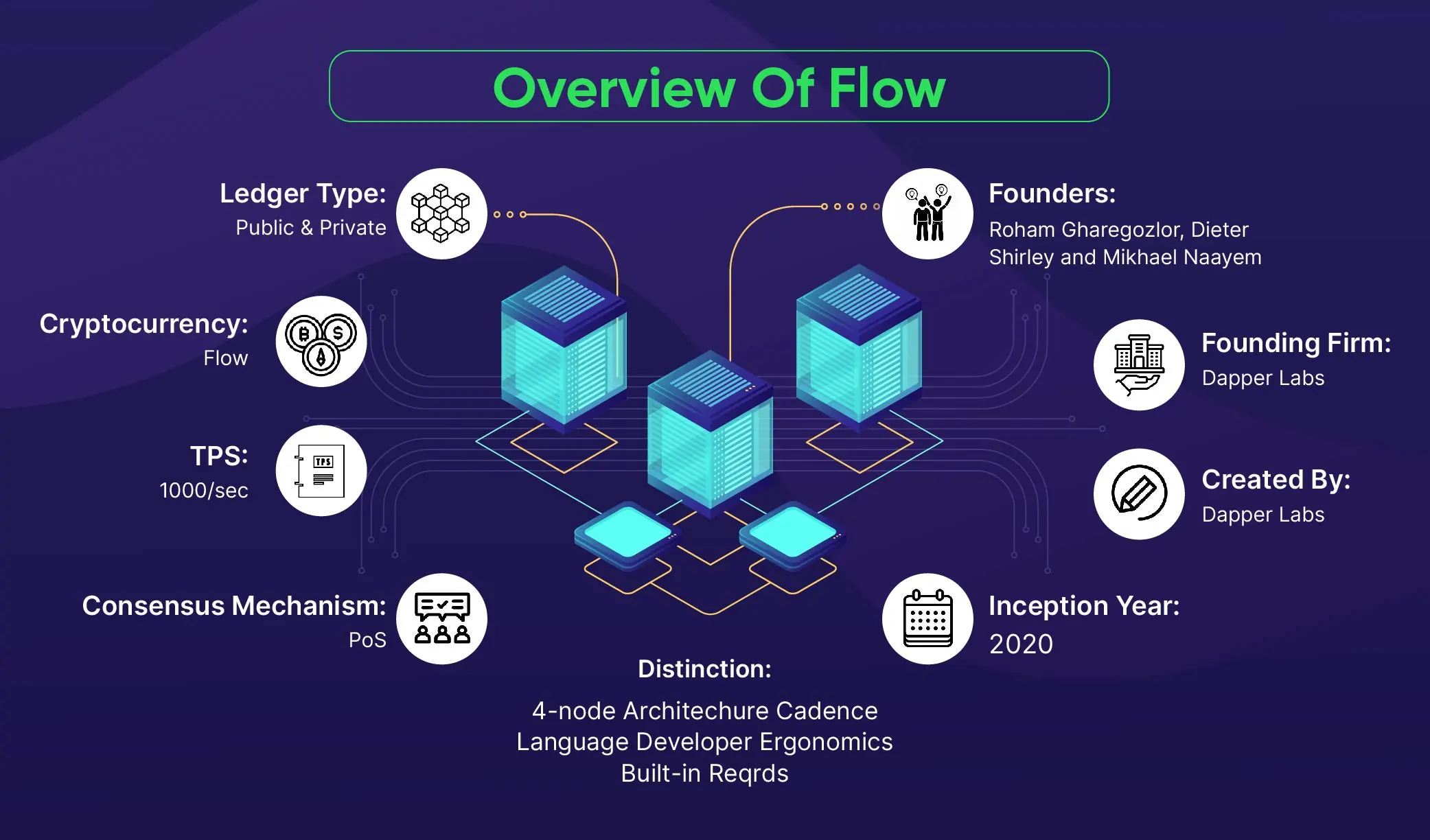

Have you ever wondered what technology powers NBA Top Shot, a popular game among many of you, or the adorable CryptoKitties you have adopted? Some of you may be familiar with it; others may not. Anyways, Flow comes with an intriguing story. In 2017, “CryptoKitties,” one of the first NFT projects, caused congestion on the Ethereum blockchain. It highlighted the need for a Blockchain platform that can handle NFT demand. So “Dapper Labs,” the developers of CryptoKitties, created their blockchain. Flow Blockchain was designed to support NFT collectibles and large-scale cryptocurrency games. Dapper Labs introduced it in 2019. Flow quickly gained popularity following its launch. It became the preferred blockchain for businesses looking to expand their user base. Blockchain Flow is a robust blockchain that powers numerous popular applications in the cryptocurrency, NFT, and gaming industries. But what exactly is Flow, and how will it influence the future of apps, games, and digital assets? Let’s prospect the fascinating world of Flow;What is Flow Blockchain?

How Does Flow Blockchain Work?

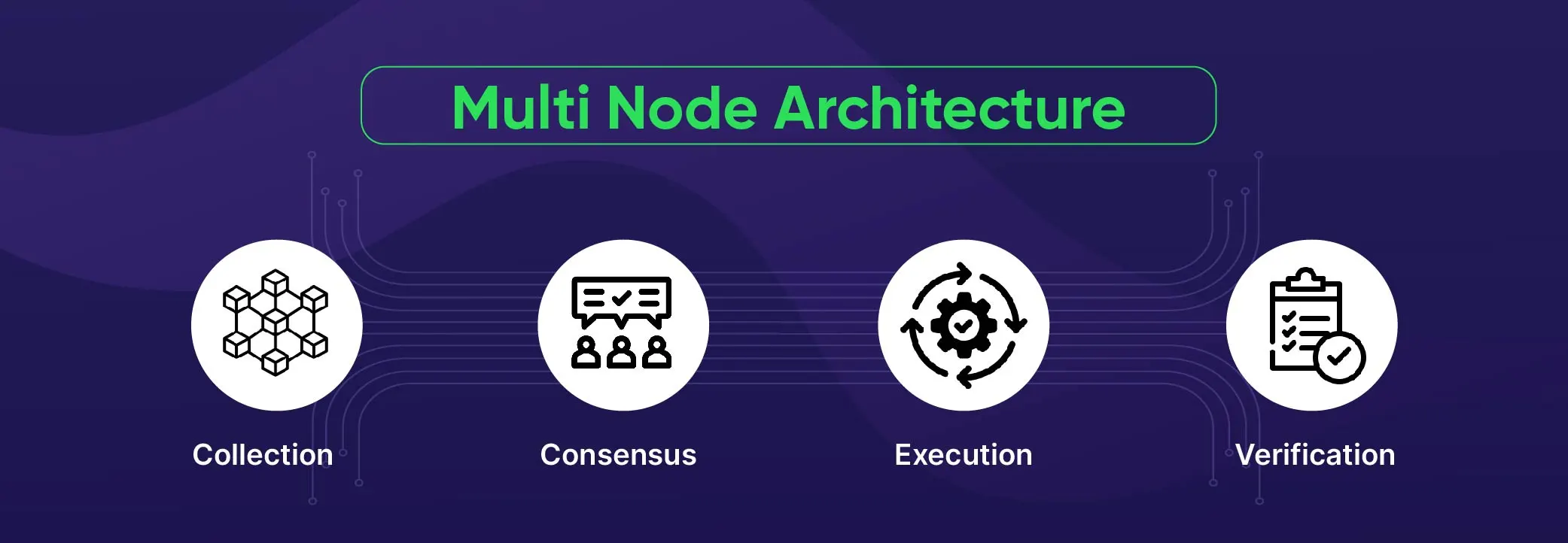

Flow blockchain stands out among various blockchain platforms because of its unique validation mechanism, which is critical for transaction processing and network security. Unlike Ethereum, Flow uses a multi-node architecture to address scalability concerns and improve overall efficiency. Ethereum, a popular blockchain platform, relies on the Proof of Stake mechanism to ensure decentralization and network security. However, it faces challenges with application scalability and transaction processing, prompting the development of Ethereum 2.0 as a Layer 2 solution to reduce costs and increase throughput. In contrast, Flow addresses these issues in a novel way by distributing transaction processing among four specialized nodes, each with its role and responsibility. Unlike Ethereum, Flow does not use off-chain solutions for network scalability, instead opting for a subdivision approach to distribute workload. Flow’s architecture is inspired by the assembly line concept in manufacturing and CPU pipeline design, with specialized nodes classified by economic situation and hardware capabilities. This structure allows for network scalability without the use of sharding, which encourages significant decentralization. Each node’s unique role contributes to the Flow blockchain’s efficiency and scalability.- Collection Nodes: Improve platform efficiency.

- Consensus Nodes: ensure decentralization.

- Execution Nodes: Increase scalability and performance.

- Verification Nodes: Ensure that the execution nodes are functioning properly.

This specialization prevents a single node from carrying the entire workload. Instead, each node performs specific tasks such as collecting transactions, verifying correctness, and reaching consensus, allowing the Flow blockchain to scale any decentralized application (dApp) built on its platform.

According to the Flow blockchain’s fundamentals, each validator node validates every transaction once, resulting in increased throughput, lower costs, and significantly improved scalability. To summarize, Flow’s unique architecture and task distribution among specialized nodes contribute to its efficiency, scalability, and uniqueness in the blockchain landscape.

This specialization prevents a single node from carrying the entire workload. Instead, each node performs specific tasks such as collecting transactions, verifying correctness, and reaching consensus, allowing the Flow blockchain to scale any decentralized application (dApp) built on its platform.

According to the Flow blockchain’s fundamentals, each validator node validates every transaction once, resulting in increased throughput, lower costs, and significantly improved scalability. To summarize, Flow’s unique architecture and task distribution among specialized nodes contribute to its efficiency, scalability, and uniqueness in the blockchain landscape.

What Fuel the Flow Blockchain?

Like every other blockchain, like Ethereum, Solana, and Polkadot, Flow uses its native cryptocurrency as fuel for the blockchain. Moreover, to settle a transaction (e.g., trigger a smart contract), users are required to pay either processing fees (simple transactions) or computation fees (complex or layered transactions).Flow Native Token: FLOW Explained

Dapper Labs envisioned the FLOW token as the standard digital currency for a new generation of crypto games, apps, and NFTs. Several reasons are making FLOW a potential winner amongst countless cryptocurrencies including, adequate distribution during the CoinList community sale, use cases that extend beyond governance and staking, and inflationary tokenomics as network usage rises.FLOW Token Utility

FLOW demonstrates an extensive list of applications, including new applications like paying for storage rental on the Flow blockchain. This variety enhances the token’s stickiness and broadens its utility.Staking Rewards:

FLOW uses a proof-of-stake consensus algorithm and it works on a multi-node architecture. Validators play an important role in this system, and those interested in becoming Flow validators must stake a minimum number of FLOW tokens. Staking FLOW tokens is required for taking on the validator role, which allows participants to earn FLOW staking rewards. Participants who want to earn FLOW staking rewards without becoming validators can delegate their stakes to existing validators. While earning rewards, delegators pay a small portion to their preferred validator, allowing for a more flexible and inclusive staking ecosystem.Higher Incentives

The staking reward mechanism is intended to provide higher incentives to validators who perform roles that are most needed at any given time. Validators can assign roles based on demand, ensuring that the network is efficient and adaptable to changing needs.Governance Token Usage

FLOW functions as a governance token on the Flow blockchain. The community intends to govern on-chain, with FLOW tokens representing a stake in the governance process. Initially, governance activities are carried out off-chain, with plans for on-chain voting in the future. FLOW token holders will propose and vote on protocol enhancements, ecosystem decisions, parameters, and hard forks.Token metrics

- Market capitalization: $1,251,694,932.

- Fully diluted market capitalization: $51,206,934,169.

- Maximum Supply: 66,913,753 FLOW

- Circulating Supply: 1,378,211,739 FLOW

- Distribution Type: Initial Coin Offering (ICO).