Introduction

Web3 & Blockchain Consultancy :

Crypto Arbitrage Bots – An Overview of Their Functionality and Types

Investors use crypto trading bots to monitor price swings in the volatile crypto market. These bots are automated tools that analyze data, identify profitable situations, and execute trades without constant attention. They also help investors scan vast amounts of data across different exchanges to find arbitrage opportunities, buying and selling cryptocurrencies at cheaper and higher exchanges, and pocketing profits in between. However, not all bots are created equal, and there are risks associated with it because prices fluctuate across crypto exchanges. Crypto arbitrage bots provide solutions to this as specialized tools. By purchasing and selling cryptocurrencies at a discount on one exchange and making money in the interim, they take advantage of price differences across other exchanges. This blog post will explain the operation of a trading bot known as “crypto arbitrage” and the risk connected to price fluctuations among crypto exchanges, features, and types as well as how you can start arbitrage trading.What is Crypto Arbitrage Bot?

Arbitrage refers to a strategy of trading that exploits market inefficiencies by exploiting mispricing between identical assets. Likewise, Crypto arbitrage bots are automated assistants that scan different crypto stores to identify price gaps between the same coins. They buy the cheap coin from one exchange and sell it at a higher price at another exchange, making a profit in between. However, the Arbitrage crypto bot became popular among investors and traders for reasons like- Popular among experienced traders and hedge funds due to substantial returns.

- Arbitrage opportunities arise when asset values are imbalanced on different exchanges.

- Exchanges often follow the market flow, increasing buying and selling activity.

- Arbitrage bot trading involves sudden changes in asset views, increased public knowledge, and sudden asset volume drops.

- Despite its fragility and fast-paced nature, arbitrage trading remains valuable for traders and investors.

Types of Crypto Arbitrage Bots?

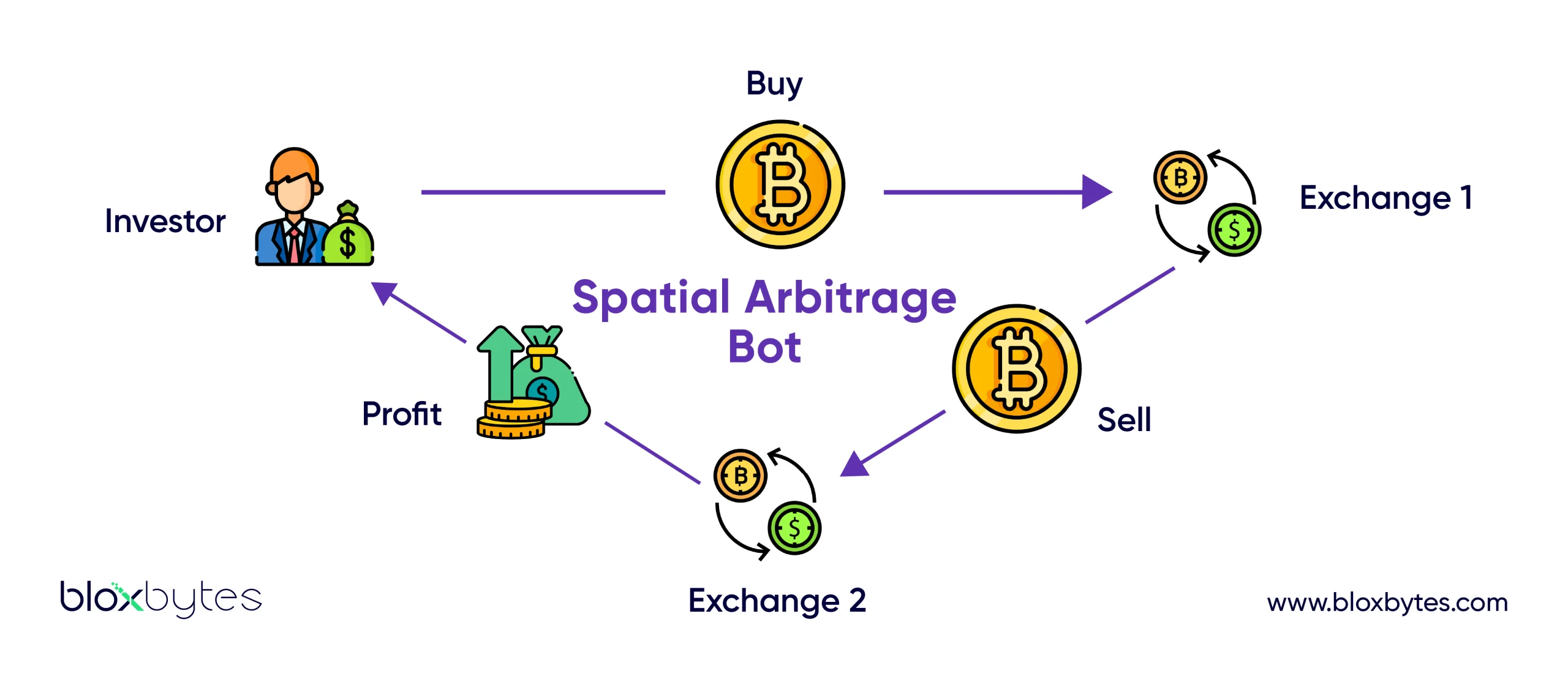

Cryptocurrency arbitrage bots, come in many flavors and each one has a unique method for spotting price differences across exchanges. If you are an investor or trader, this list will help which one might suit you the most:1. Spatial Arbitrage Bot

This bot works as a geographical bot as it uses time zones to exploit price gaps between exchanges worldwide. It scans exchanges, looking for situations where a cryptocurrency is cheaper in one location due to its being earlier in the day compared to another. The bot then buys the cheaper coin and sells it on the exchange with the higher price, pocketing the profit before the markets catch up. This is beneficial for Investors who can tolerate a longer time horizon, as these gaps may take longer to manifest and close. However, these gaps can close quickly as markets adjust, so extra monitoring is needed to capitalize on opportunities at the right moment.

Spatial Arbitrage Mechanism

- A trader buys tokens on Binance at a lower price.

- A trader sells tokens on FTX at higher prices.

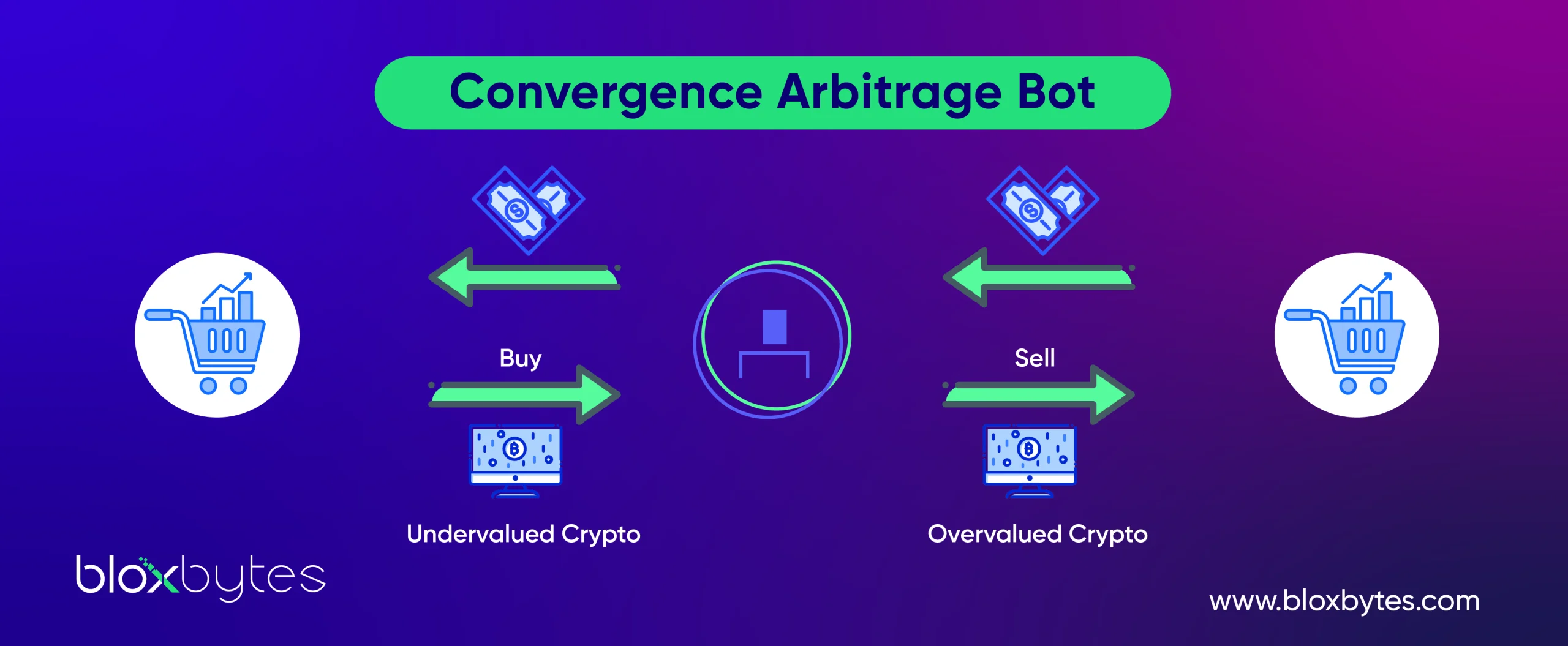

2. Convergence Arbitrage Bot

This bot works as the price Matchmaker. This convergence arbitrage is a trading strategy that uses price adjustments to capture profits before prices become identical. It works by monitoring exchanges and looking for cryptocurrencies that are slightly overpriced on one exchange compared to another. When prices are getting closer together, the bot buys the slightly cheaper coin and sells it on the exchange with the slightly higher price, capturing a profit before the prices become identical. This strategy is beneficial for investors looking for faster opportunities, as price adjustments can happen relatively quickly. However, it’s important to note that these convergence windows can be fleeting, and the bot needs to be precise to capture the profit before the prices completely match.

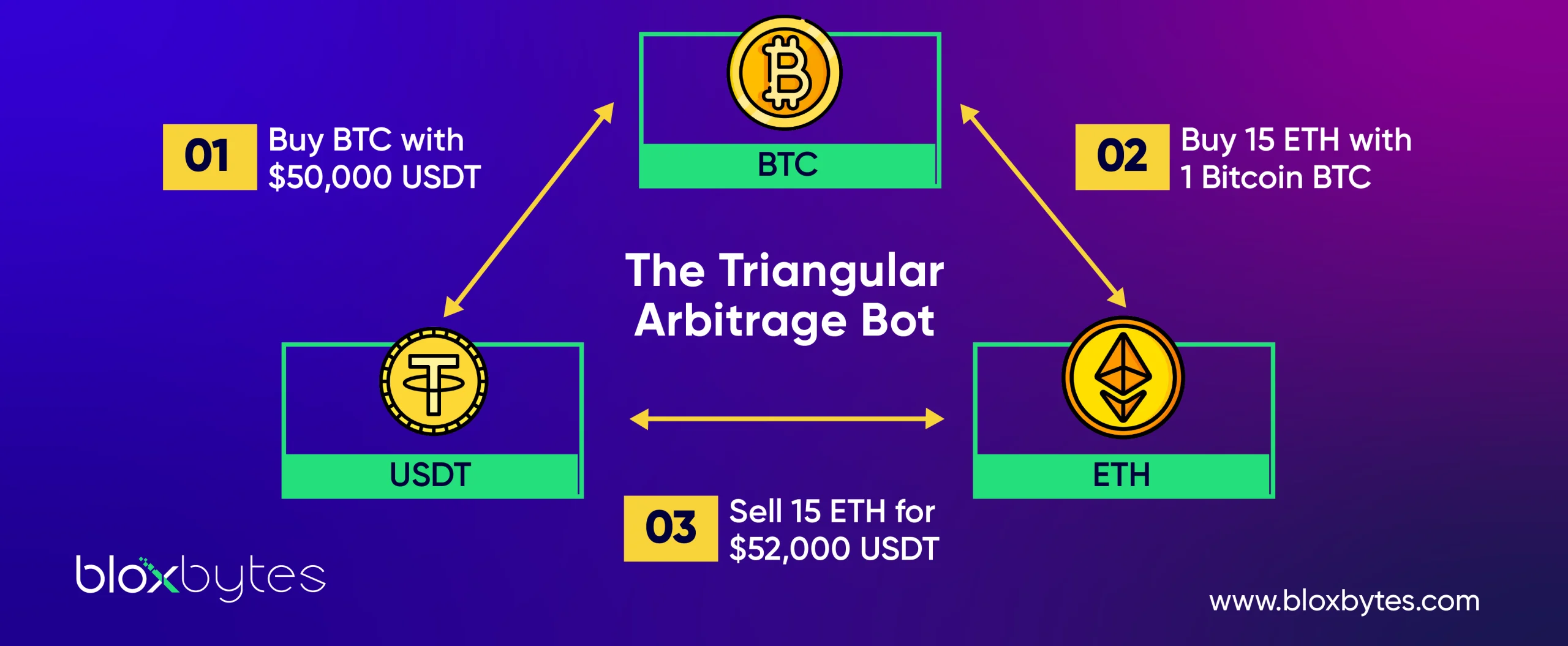

3. Triangular Arbitrage Bot

This is a three-legged bot mechanism across different cryptocurrencies. It buys low on one exchange, trades up using that cheap coin to buy a second cryptocurrency on a more favorable exchange, and then sells the second cryptocurrency for a profit in the original currency back on the first exchange. This algorithmic speed is good for experienced crypto users who enjoy challenges. Triangular arbitrage can be more profitable than other bot strategies but involves more complex calculations and carries higher risk. Before using this bot, ensure you understand the risks and choose a reputable provider.

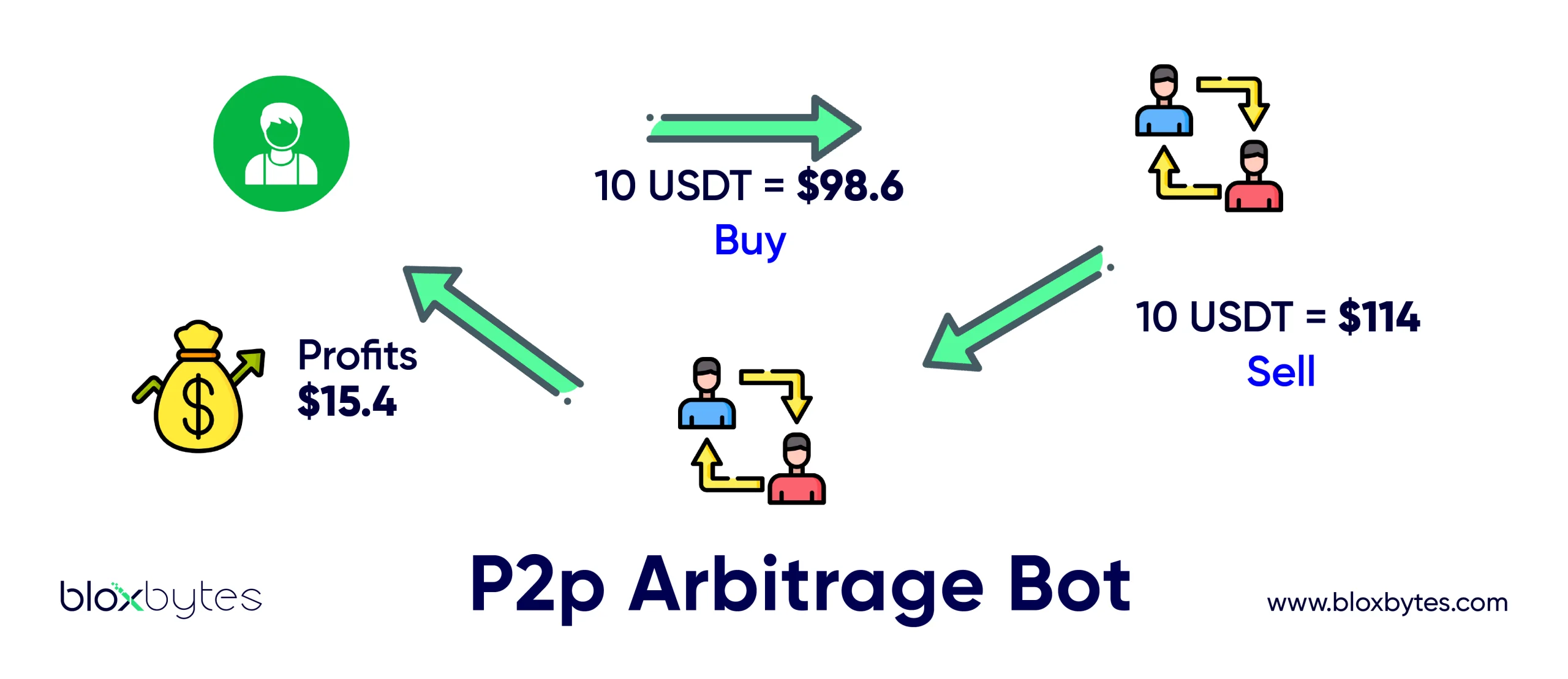

4. P2P Arbitrage Bot

The growth of p2p exchanges and then p2p arbitrage is because crypto activities are banned in some countries’ banks. Arbitrageurs can buy and sell crypto assets using p2p trading or acquire cryptocurrency on low-fee centralized exchanges and sell it on p2p marketplaces. Two common schemes bring p2p arbitrageurs money: selling on a higher asset exchange rate marketplace and buying on another platform with a lower exchange rate. For instance, imagine buying 1 euro for 1.20 Singapore dollars (SGD) at the standard exchange rate. Then, you transfer that euro to a P2P exchange and discover you can sell it for 1.25 SGD. This seemingly small difference translates to a nearly 4% profit for the arbitrageur.

How Arbitrage Crypto Can Generate Profit?

Arbitrage crypto techniques can be a lucrative business venture. However, there is a need to acquire both fiat and crypto on the exchange platforms you operate on. You need to check on which exchanges require KYC verification and be aware of transaction costs. Crypto exchanges often have withdrawal limits and AML checks for larger sums of funds, which can take weeks. Additionally, moving assets from one exchange to another incurs withdrawal, deposit, and trading fees, which negate potential profits. Despite the challenges, trading bots can overcome these obstacles, as they keep all variables in mind 24/7, making it easier for traders to make a living from cryptocurrency arbitrage. Let’s see how arbitrage trading crypto keeps a global financial system healthy:- It involves counterparties acting as financial intermediaries, detecting and resolving market inefficiencies.

- Unlike traditional day trading or swing trading, crypto arbitrage doesn’t impose risks due to its focus on real-time opportunities.

- Arbitrage trading enhances market efficiency, making financial markets more liquid and robust.

- It ensures global securities prices align, leading to better price discovery and tight spreads.

- The fewer market opportunities in crypto arbitrage make it more fair and liquid.

The Dark Side

With arbitrage strategies, risks are associated but many traders call arbitrage a low-risk strategy. But is that true? It’s okay if you think arbitrage trading can be simple. This is difficult in practice, even in theory. An arbitrageur’s chances of making a profit can be considerably decreased by certain factors. Thus, the largest arbitrage risks related to cryptocurrency are: Despite being perceived as a low-risk strategy, arbitrage trading can be difficult in real life for several reasons. The below factors can significantly reduce an arbitrageur’s chances of profit.- One of these is low liquidity, which can result in price slippage if a trade is executed at a price that is not what was anticipated.

- The price of the same asset may fluctuate due to market fluctuations, and arbitrageurs must execute large volumes of trades to make significant profits.

- Arbitrage deals are not profitable, even with large deposits.

- The more arbitrage deals are made, the more balanced exchanges become, and the shift in demand and supply affects order books and liquidity pools.

- Arbitrage fees, such as maker/taker, withdrawal, fiat deposit, and credit card payments, must be considered when calculating profits.

- Taxes apply only to certain countries, and if assets are traded back and forth, the exchange may freeze money.