Introduction

Blockchain & Web3 Services Trusted By Leaders

- Develop innovative solutions using our state-of-the-art blockchain expertise.

- Achieve accelerated growth with robust & scalable Web3 consulting.

- Unlock 360-degree security with our top-rated blockchain development.

Is Blockchain the Answer to Secure Digital Transactions?

Traditionally, financial services were prone to hacks because records were human-written. The result was unsecured transactions which hindered access to money. Because of this, consumers face issues like stolen funds and loss of trust in financial institutions. However, Businesses face risks from cyberattacks and lack of transparency, which can hinder efficient trade and financial operations. Blockchain has revolutionized financial services. From banks to investments, trade finance to payments by providing greater security, transparency, and efficiency in the financial system. This blog post explores use cases of Blockchain in financial services and the need for security, emphasizing the importance of a secure digital transaction for both consumers and businesses.What Are Secure Transactions?

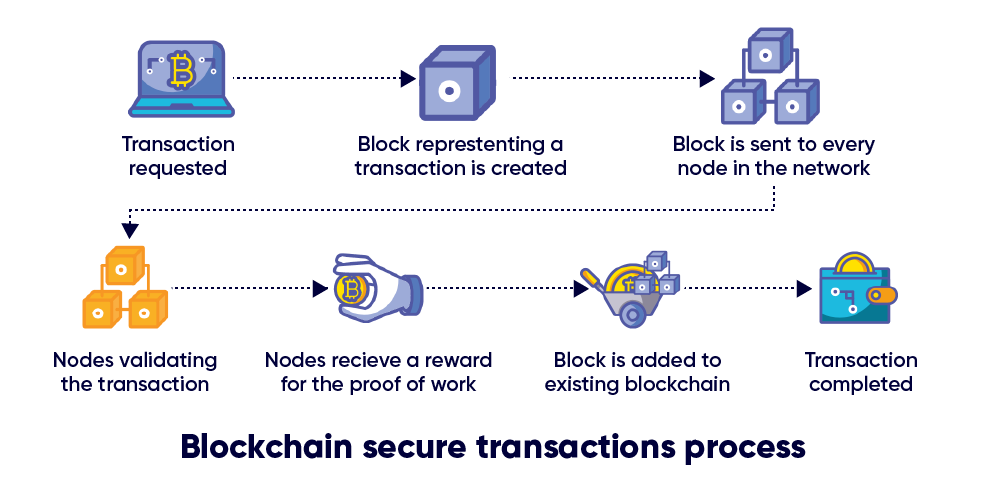

The Role of Blockchain In Securing Digital Transactions?

Blockchain technology eliminates the need for centralized intermediaries and eliminates a single point of failure that was usual in traditional systems. The blockchain consensus mechanism uses strong cryptography algorithms, encryption, and verification processes to prevent unauthorized tampering with sensitive data. Digital signatures ensure all parties are who they claim to be. On the other hand, Smart contracts automate transaction processes, reducing fraud and human error. They function like digital watchdogs, ensuring everything proceeds as planned and by agreed parameters. Thus, Blockchain is a security powerhouse that makes internet transactions more secure and reliable!What is Blockchain For Financial Services?

The fintech blockchain industry uses big data that is prone to hacking or alteration. Blockchain and fintech together can protect data analytics with machine learning, and artificial intelligence. It can improve financial services like digital payments using digital currency, peer-to-peer lending, and mobile banking. Also, Blockchain enables faster, cheaper cross-border payments, facilitates peer-to-peer lending, and automates contract execution, reducing manual intervention and minimizing errors.Use Cases of Blockchain for Financial Services

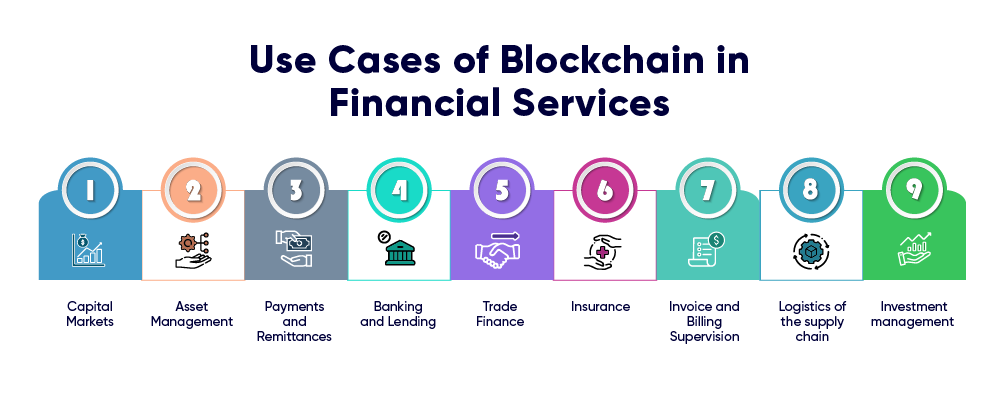

Blockchain has fueled the financial services industry with major and significant transformations. Here’s a breakdown of some prominent use cases:

1. Capital Markets

Blockchain technology streamlines securities issuing, sales and trading, clearing and settlement, post-trade services, asset servicing, and custody, reducing paperwork and intermediaries. It also automates post-trade services, improves transparency, and simplifies tasks like custody management and proxy voting. Additionally, it acts as a secure digital vault for storing financial assets.

2. Asset Management

Automating fund launch tasks, cap table management, and transfer agency in asset management can reduce costs and expedite launch times while providing transparency and immutable ownership records for stakeholders and improving efficiency.

3. Payments and Remittances

Blockchain technology is revolutionizing domestic retail payments, enabling faster and cheaper transactions by eliminating intermediaries and transaction fees. It also streamlines high-value domestic transactions like wholesale payments and securities trades. Cross-border payments are now easier and cheaper due to near-real-time settlements. Central banks and financial institutions are exploring blockchain for digital versions of traditional fiat currencies and stablecoins.

4. Banking and Lending

Blockchain enhances credit prediction and scoring by securely storing and sharing credit data, facilitating access for underserved populations. It automates loan syndication, underwriting, and disbursement, reducing costs and improving efficiency. It also manages collateralized assets for transparency.

5. Trade Finance

Blockchain technology helps automate the issuance and processing of letters of credit and bills of lading, crucial documents in trade finance. It reduces fraud and expediting trade transactions. Furthermore, it facilitates the creation and management of complex trade finance structures. These structures help improve transparency and efficiency within the trade finance ecosystem.

6. Insurance

Blockchain automates claims processing and disbursement, reducing costs and expediting payouts. However, smart contracts work as self-executing insurance contracts, improving efficiency and transparency. This, streamlines reinsurance processes through secure, transparent data sharing, reducing costs and improving efficiency.

7. Investment management

By enabling fractional ownership and tokenization of assets on blockchain networks, people can now make investments in assets that were previously illiquid, such as artwork or real estate. This increases ownership transparency and investment options.

8. Invoice and Billing Supervision

Smart contracts implemented in blockchain technology automate and streamline invoice and billing procedures, thereby avoiding conflicts and delays. This is particularly beneficial for trade and supply chain finance.

9. Logistics of the supply chain

Blockchain improves traceability and transparency in supply chains by enabling participants to monitor the movement of items and verify authenticity, lowering fraud, and expediting procedures like recalls and provenance checks.

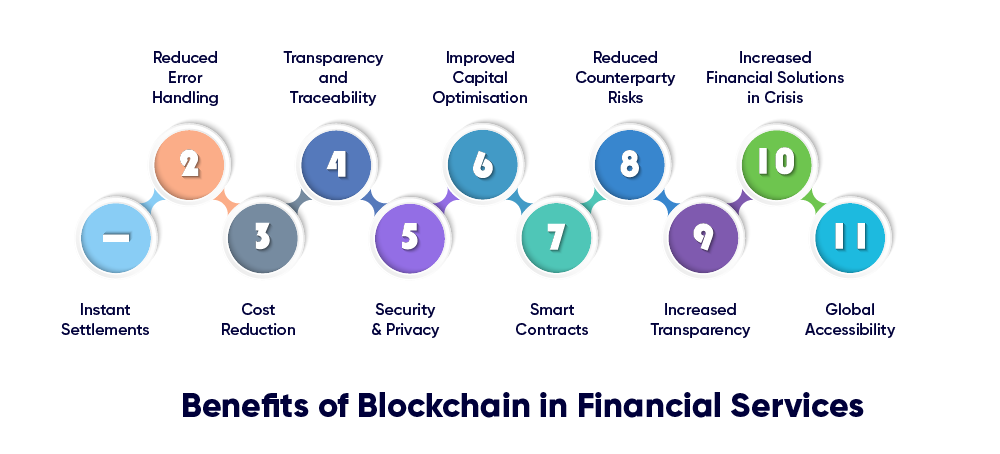

Blockchain Benefits in Financial Services

Digital ledger technology can bring a lot of benefits to the finance industry. The financial services industry has embraced blockchain to improve many of its outdated systems. This helped them save money, making trade faster and cheaper. Some of the benefits are:

- Instant Settlements: Blockchain allows for quick and efficient settlements, saving time and money for both parties involved. This eliminates the need for middle and back office staff.

- Improved Capital Optimisation: Blockchain eliminates the need for trusted intermediaries, reducing operational costs for banks.

- Reduced Counterparty Risks: Transactions settled nearly instantly eliminate the risk that the counterparty cannot meet its obligations.

- Smart Contracts: Smart contracts execute automatically once certain conditions are met, improving contractual term performance.

- Increased Transparency: Blockchain increases transparency among financial institutions, improving regulatory reporting and monitoring by central banks.

- Increased Financial Solutions in Crisis: Blockchain provides increased options for financial solutions in times of crisis, such as the Bitfinex hack.

- Reduced Error Handling: Blockchain’s immutability allows for real-time tracking of recorded data, eliminating error handling and reconciliation.

- Cost Reduction: Blockchain lowers transaction costs and operational overhead by doing away with middlemen and automating procedures, providing affordable financial services solutions.

- Transparency and Traceability: Financial transactions are made transparent and traceable thanks to blockchain’s transparent and unchangeable ledger, which also increases participant confidence and accountability.

- Security & Privacy: Sensitive financial data is protected, and the risk of fraud and cyberattacks is reduced thanks to blockchain’s decentralized architecture and encryption technology.

- Global Accessibility: Blockchain makes financial services accessible to people everywhere. This is especially helpful for marginalized groups and people living in areas with poor access to traditional banking infrastructure.

The Future of blockchain in financial services

The use cases of blockchain for the finance industry will extend beyond existing applications as major banks and financial institutions are expected to integrate blockchain solutions into their core operations, leading to a more streamlined and efficient financial system. On the other hand, the rise of smart contracts will also revolutionize areas like automated investing and insurance claims processing. Emerging markets will benefit from blockchain’s ability to provide secure and accessible financial services, empowering individuals in unbanked or underbanked regions. Moreover, security enhancements will be essential for mass adoption in finance, with research into sustainable and scalable blockchain solutions ongoing. But the question is why there is a need for secured transactions?Why There is a Need for Secure Transactions?

Consumers deal with stolen funds, identity theft, and a loss of trust in financial institutions. Unsecured transactions can also be slow and cumbersome, with funds taking days to settle, hindering access to money. On the other hand, businesses face significant risks from fraud and cyberattacks. They also incur high costs associated with intermediaries and manual processing in traditional financial systems. Additionally, a lack of transparency can hinder efficient trade and financial operations.Is Blockchain the Answer to Secure Financial Future?

The future of blockchain in financial services is promising, with collaboration between industry leaders, regulators, and innovators. The use of blockchain can eliminate a single point of failure by making systems highly resistant to cyberattacks. Its encryption and tamper-proof ledger ensure data integrity and prevent fraudulent alterations. Transparency allows authorized participants to view transaction details, fostering trust and accountability within the financial ecosystem.Who Will Get the Benefit?

- Consumers: Blockchain provides enhanced security, faster transactions, reduced costs, greater control over financial information and transactions, and reduced costs due to the elimination of intermediaries.

- Businesses: Businesses benefit from improved security, increased efficiency, enhanced transparency, and new opportunities, such as secure P2P payments and fractional ownership of assets.