Introduction

Blockchain & Web3 Services Trusted By Leaders

- Develop innovative solutions using our state-of-the-art blockchain expertise.

- Achieve accelerated growth with robust & scalable Web3 consulting.

- Unlock 360-degree security with our top-rated blockchain development.

Digital Currency and Its Types: The Future of Finance

For centuries, people used tangible currency (coins and banknotes) to buy goods and services, exchanging money hand to hand. As technology evolved, so did our payment methods. From tangible cash to digital transactions, we’ve entered a cashless era. But what does the future hold for the money and finance sector in this digital age? Today, online shopping and cryptocurrencies like Bitcoin are shaping the future of finance. Moreover, cryptocurrency wallets and payment apps have become ubiquitous as they offer instant access to funds and seamless transactions at the tap of a screen. With new technologies and innovations like blockchain and DeFi, there is a shift of advancement to a more inclusive and transparent financial system. Let’s explore what is digital currency, how it works, its advantages and disadvantages, and how digital transformation gives limitless possibilities for the future of money. Let’s start;What is Digital Currency?

How Does Digital Currency Work?

Digital currencies primarily work on blockchain technology. This means they are decentralized forms of currency that operate on decentralized networks. Because of their decentralized nature, they allow for faster and more accessible transactions. However, blockchain which is a public ledger records transactions held by currency holders. They are created through mining (a process using computer power to solve mathematical problems). Users can buy and store currencies from brokers, using cryptographic wallets. Blockchain private key QR codes and cryptographic signatures are stored in Digital Wallets to provide the ownership of a currency. Digital wallets come in various forms, including software, hardware, and paper wallets, offering different levels of security and accessibility. It is worthwhile to mention that digital currencies have an intangible nature, allowing seamless transactions across borders and eliminating the need for physical cash. This decentralized and efficient alternative to traditional forms of money revolutionizes the way we conduct financial transactions in the digital age.Types of Digital Currencies

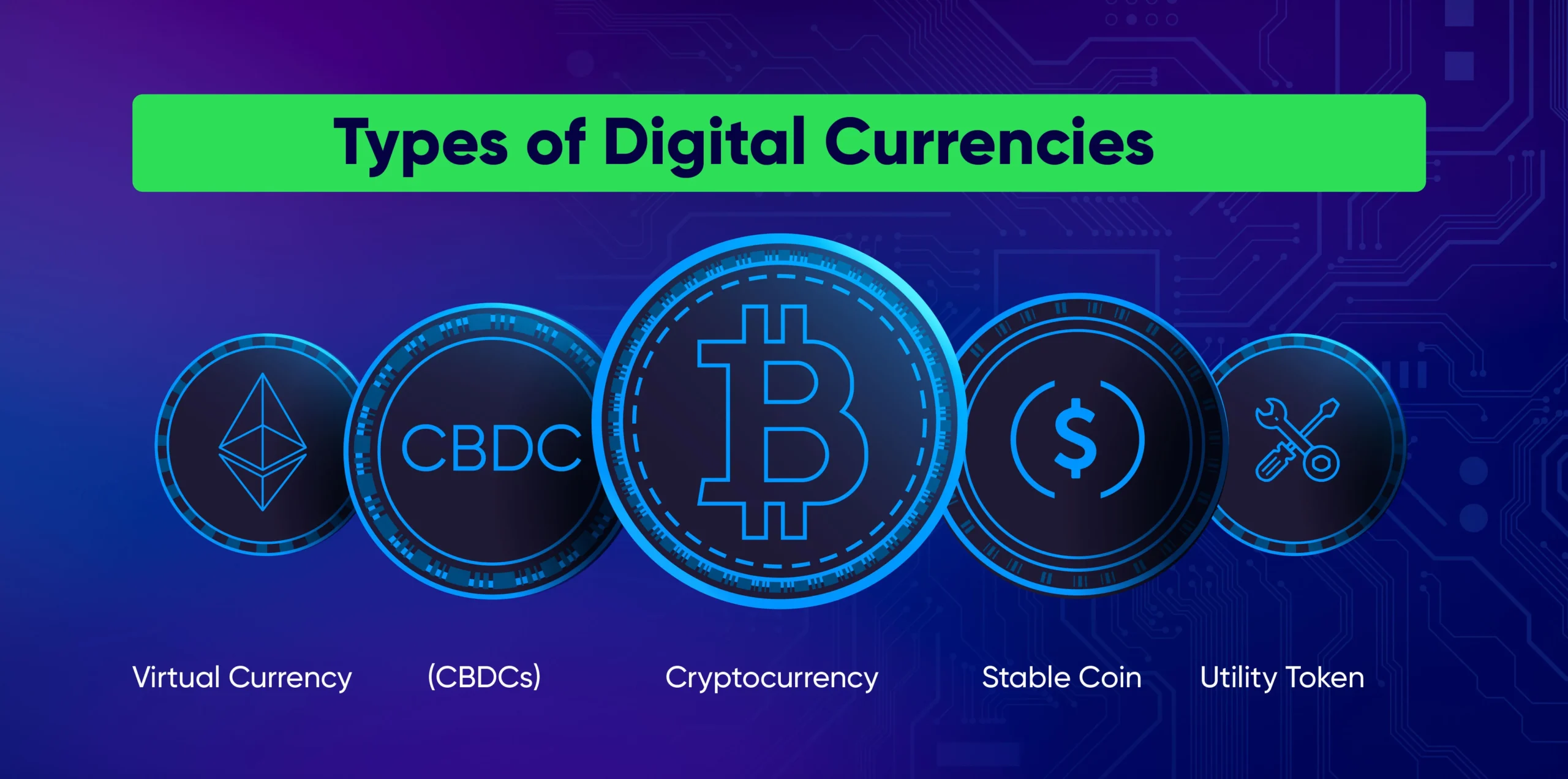

Digital currency is gaining popularity in the finance and commerce industry. However, Digital currencies are classified into four types: cryptocurrency, central bank digital currency, virtual currencies, utility tokens, and stablecoins. Let’s explain it one by one;

-

Cryptocurrency

Cryptocurrencies operate on a blockchain. This means no central authority is involved in governing transactions. That is why cryptocurrencies offer decentralization, cross-border transactions, and stability. These features offer users a level of anonymity as transactions are pseudonymous, enhancing privacy. However, by utilizing cryptographic methods, cryptocurrencies secure transactions, ensuring the integrity and authenticity of each transaction recorded on a blockchain ledger. In essence, cryptocurrencies like Ethereum, Bitcoin, and Litecoin are the most profitable and volatile assets in the digital world.

-

Central Bank Digital Currency (CBDCs)

Central Bank Digital Currency is a digital currency similar to digital money that the central bank creates and manages. It is a better version of traditional cash that is stored electronically. CBDCs are designed to maintain stability and regulatory oversight while simplifying financial transactions. It is a modern solution to keep up with the changing financial landscape, particularly as cryptocurrencies and other digital currencies gain popularity. CBDCs include the Central Bank of The Bahamas (Sand Dollar), Eastern Caribbean Central Bank (DCash), Central Bank of Nigeria (e-Naira), and Bank of Jamaica (JamDex).

For example;

China’s digital yuan is being piloted for lottery winners, with potential for cross-border payments and international trade. It is still under experimentation, once fully implemented, it will be accessible through banks and mobile payment providers. However, widespread adoption requires collaboration among stakeholders, regulatory bodies, and technological advancements to ensure security, accessibility, and efficiency.

-

Virtual Currency

Virtual currencies are unregulated and are primarily used in virtual worlds or online gaming ecosystems. They operate independently and are controlled by developers or a platform’s founding organization. Their purpose is to facilitate transactions between users. Virtual currency allows users to purchase virtual goods like weapons and clothing.

-

Stable Coin

Stablecoins are purposely designed to maintain a stable value compared to traditional currencies or other assets. Their goal is to provide reliability and stability in value, making them suitable for everyday transactions and financial activities.

Stablecoins can be backed by reserves of traditional fiat currencies or use algorithmic mechanisms to adjust supply based on market demand. Stablecoins have gained attention in decentralized finance (DeFi) and digital payments, offering fast and inexpensive transactions while mitigating price fluctuations.

-

Utility Token

Utility tokens share similarities with other digital currencies like cryptocurrencies. However, they are distinct in their purpose and function within decentralized ecosystems. Unlike traditional currencies, these tokens serve as digital assets that offer access to specific products or services within a decentralized ecosystem. They are created and distributed through initial coin offerings (ICOs) or token sales by blockchain-based projects. Holders of utility tokens typically gain access to features, functionalities, or benefits offered by the project or platform.

Therefore, it serves a unique role in facilitating interactions and incentivizing participation within decentralized applications and ecosystems.

Interesting Fact

Developers define and manage virtual currencies’ value and economics, often through a predetermined network protocol or algorithm, like a gaming network token, subject to their rules and parameters.Advantages and Disadvantages of Digital Currencies

⇒ Cryptocurrency

| Advantages | Disadvantages |

| Decentralization and anonymity by providing privacy and decentralized transactions. | Cryptocurrency prices have risks as they can fluctuate, leading to investor uncertainty. |

| High potential for value appreciation by attracting investors seeking high returns. | The lack of regulatory oversight in cryptocurrencies exposes investors to market instability. |

| Borderless transactions help enable global fund transfers without intermediaries. | There are security concerns of cryptocurrency transactions that require robust security measures. |

⇒ CBDCs Crypto

| Advantages | Disadvantages |

| Enhances security through blockchain technology for secure, transparent transactions. | CBDCs are vulnerable to cyberattacks and data breaches, affecting financial stability and user privacy. |

| Promotes financial inclusion by providing banking services to unbanked populations. | Compliance with financial regulations and international standards may slow CBDC adoption. |

| Ensures efficiency and transparency through real-time monitoring and auditing. | Coordinating with existing payment systems and blockchain networks is a challenge. |

⇒ Virtual Currency

| Advantages | Disadvantages |

| Streamline online transactions, offering a seamless and user-friendly alternative to traditional banking systems. | Lack of government regulation exposes to risks like fraud, scams, and illicit activities. |

| Provide financial services to individuals, fostering financial inclusion and empowerment. | Volatile assets and posing risks for investors and users alike. |

| Lower transaction fees compared to traditional banking methods, reducing the overall cost of financial transactions for users. | Susceptible to cybersecurity threats like hacking, theft, and data breaches. |

⇒ Stable Coin

| Advantages | Disadvantages |

| Constant value provides predictable investment. | Centralization raises transparency and control concerns. |

| Pegging to underlying assets minimizes price fluctuations. | Users face stability and reliability risks. |

| Enables quick, cost-effective cross-border transactions. | Regulatory hurdles may arise due to financial stability, fraud, and compliance issues. |

⇒ Utility Token

| Advantages | Disadvantages |

| Grant holders access to specific products, services, or functionalities. | Regulatory uncertainty hinders the adoption and use of utility tokens. |

| Incentivize user engagement, fostering community growth. | High volatility due to market speculation and project developments. |

| Offer flexibility in use cases, enhancing token utility and value proposition. | Limited liquidity impacts tradability and market acceptance of nascent or niche projects. |

Examples of Digital Currencies

Here are some real-life examples of each type of digital currency;⇒ Cryptocurrency

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold.

- Ethereum (ETH): A decentralized platform enabling smart contracts and decentralized applications (DApps).

- Ripple (XRP): A digital payment protocol and cryptocurrency designed for fast, low-cost cross-border transactions.

- Litecoin (LTC): A peer-to-peer cryptocurrency created as a “silver to Bitcoin’s gold,” offering faster transaction confirmations.

⇒ Central Bank Digital Currency (CBDC)

- Digital Yuan: China’s central bank digital currency (CBDC) issued by the People’s Bank of China (PBOC), undergoing pilot testing in various cities.

- e-Euro: The European Central Bank (ECB) is exploring the concept of a digital euro as a potential CBDC, aiming to enhance payment efficiency and financial inclusion.

- Digital Dollar: The United States is considering the development of a digital dollar to modernize payment systems and address financial inclusion challenges.

- Sand Dollar: The Central Bank of The Bahamas launched the Sand Dollar as the world’s first central bank digital currency (CBDC) fully deployed nationwide, aimed at improving financial access and efficiency in the country.

⇒ Virtual Currency

- Fortnite V-Bucks: In-game currency used within the popular video game Fortnite, allowing players to purchase cosmetic items and battle passes.

- Robux: The virtual currency used in the online gaming platform Roblox, enabling players to purchase virtual items, accessories, and upgrades.

- Linden Dollars (L$): The virtual currency used in the virtual world of Second Life, facilitating virtual transactions and commerce within the platform.

- EVE Online ISK: The in-game currency of the massively multiplayer online role-playing game (MMORPG) EVE Online, used for trading, crafting, and in-game activities.

⇒ Stablecoin

- Tether (USDT): A stablecoin pegged to the value of the US dollar, providing stability amidst volatile cryptocurrency markets.

- USD Coin (USDC): Another stablecoin backed by US dollars on a 1:1 basis, facilitating seamless fiat-to-crypto conversions.

- Dai (DAI): A decentralized stablecoin built on the Ethereum blockchain, maintained through a system of collateralized debt positions (CDPs).

- TrueUSD (TUSD): A USD-backed stablecoin designed to provide transparency and regulatory compliance in the stablecoin market.

⇒ Utility Token

- Binance Coin (BNB): The native cryptocurrency of the Binance exchange, used to pay for trading fees, token sales, and other platform utilities.

- Basic Attention Token (BAT): A utility token integrated with the Brave browser, rewarding users for engaging with ads and content creators for their contributions.

- Chainlink: A decentralized oracle network that enables smart contracts to securely interact with real-world data, powered by the LINK utility token.

- Filecoin (FIL): A utility token used to access decentralized storage services on the Filecoin network, incentivizing miners to provide storage space and retrieve data.