Introduction

Web3 & Blockchain Consultancy :

What Is Tokenomics And Factors that Relate To Crypto’s Future Value?

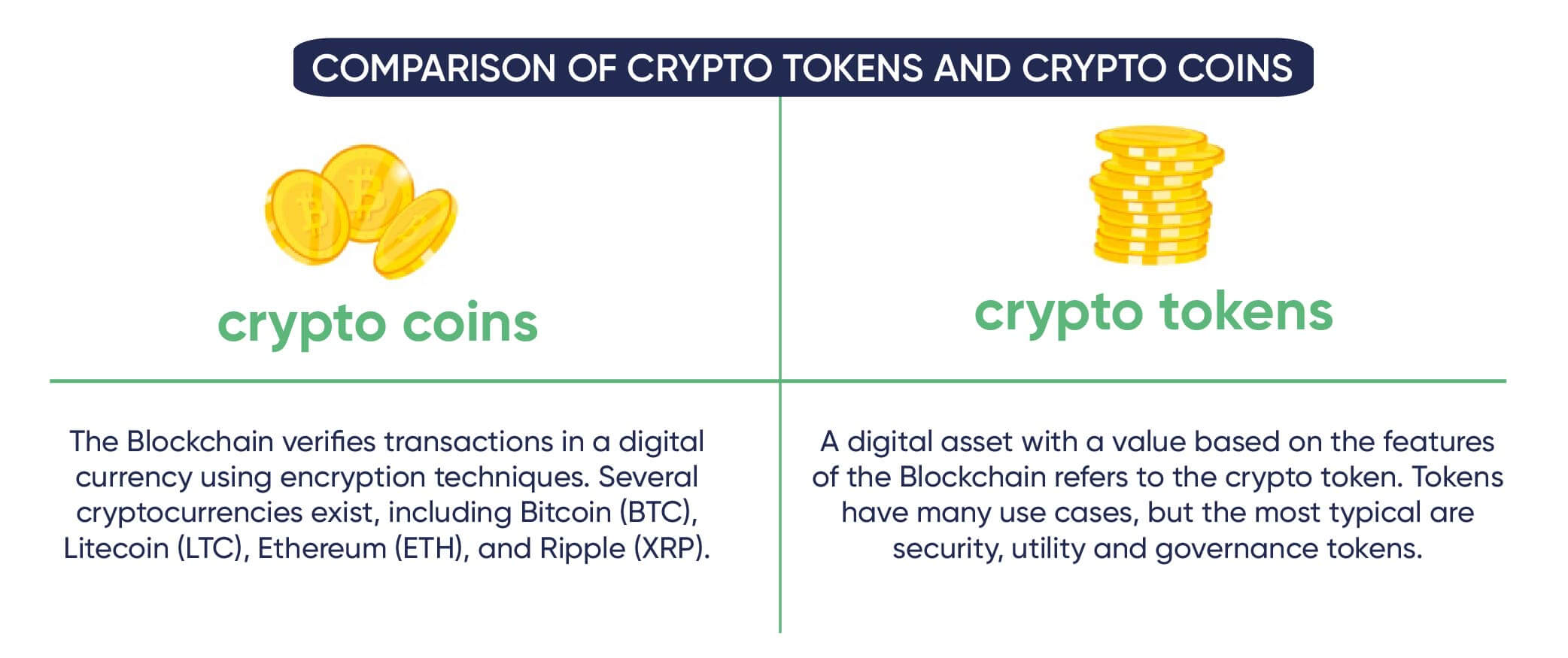

The definition of a crypto token is the first step toward understanding tokenomics. Crypto tokens run on blockchains. They offer many incentives to holders, allowing them to exchange or swap tokens with another blockchain. Tokenomics refers to all of a crypto token’s features that make it desirable to investors. Furthermore, Blockchain is associated with cryptocurrency, and for a blockchain to work, it needs to be used by people. So likewise, if no one uses cryptocurrency or tokens related to Blockchain, its value will be zero. The widespread adoption of cryptocurrency has led to many different currencies. This process will remain balanced if the crypto has its actual use case: payment and storage. The more services it has, its demand and value will increase to keep tokenomics in a state of balance. In this blog, I divided this into two parts, Tokenomics, and future crypto value.What is Tokenomics?

A tokenomics is a process to determine the value of a token. Research involves tokens (or coins), cryptocurrencies, and their respective blockchains. However, tokenomics is not limited to this scope. Tokenomics also refers to the structure and characteristics of a crypto project’s token. Tokenomics is the term used to describe the functionalities associated with a token and how it incentivises its holders, creates value, and increases demand. Projects can use tokenomics to develop a robust micro-economy.

Basics of tokenomics

Each blockchain project has its tokenomics rules. These rules can promote or discourage certain user behaviors. Likewise, a central bank prints money implements monetary policies, and encourages or prevents spending, lending, saving, and money movement. Notably, tokens and coins are considered “tokens” in the context of Blockchain. Therefore, Tokenomics’ rules are transparent, predictable, and challenging to change, unlike fiat currencies. For example, The Bitcoin network is pre-programmed to produce a total of 31 million bitcoins, which is half the number of coins users can mine. Miners receive bitcoins as a reward when they mine a block, also known as the block subsidy.

Agenda of these rules:

It helps ensure that Bitcoin remains scarce and valuable. Concomitantly, it protects against inflation because the number of blocks on the Bitcoin network is fixed (the number cannot change). If there were no limit on how many bitcoins could mine in any given period, then there would be no incentive to spend them because they would lose value over time due to inflation. Consequently, it is easier to calculate the number of bitcoins that users will mine annually. It is, therefore, possible to estimate the number of bitcoins users will mine each year.Factors that Relate To Crypto’s Future Value

Distribution of tokens:

There are two primary methods of generating crypto tokens.

-

- Pre-mining

-

- Fair launch

According to this model, all investors and communities interested in the project will receive equal treatment. From the very beginning, the coin/token must be decentralized and owned, managed, and earned by the community. Participation is open to everyone. There is no early access, pre-mining, or allocation of tokens—for example, Bitcoin.

On the other hand, pre-mining involves creating and distributing crypto tokens before going public (primarily to project developers or other team members).

Several cryptocurrency projects have minted their tokens before going live this year. There is nothing to worry about a project that minted some tokens before launching it. It’sIt’s also possible to assume that the project is legitimate if it distributes its tokens to as many people as possible. For your project to become sustainable, BloxBytes’ groundbreaking tokenomics consulting process (INTERNAL LINK) will help create a sustainable economy.

Token Models:

Token-based economic models are vastly superior to government-controlled ones because they’re built with mathematical rules and governed by a community. Compare this with the monetary decisions of central banks, which remove input from currency holders and create money without restriction. However, no economic model is perfect, especially a brand-new one.

Token economic models come in various flavors. Take a look at the most common token models, how they benefit cryptocurrencies, and where they might fall short.

Deflationary:

A deflationary token model ensures that there will never be more than 21 million coins. This model creates a situation where demand may increase while supply remains limited, resulting in rising prices over time.

Inflationary:

There is no end to the production of inflationary tokens. A cap does not limit tokens, and there is no maximum supply.

Dual-token model:

A dual token model includes both utility and security tokens. As part of the fundraising process, some companies sell tokens that provide access to the digital platform they are building. A dual token model includes both security and utility tokens.

For example, Axie Infinity has a dual-token model.

Supply of a Token:

The supply of tokens is one of the most crucial elements in tokenomics. There are three types of supply of a token:

-

-

-

- Circulating supply represents the number of tokens currently available on the market.

- No burned or lost tokens are in the total token supply.

- Max supply cap of a token is the maximum number of tokens that can ever exist.

-

-

For some tokens like Bitcoin, there’s no predetermined supply cap; their issuance is limited only by how many people are willing to mine or buy them. As a result, the number of tokens can give investors an indication of whether that token is likely to rise or dip in value. In extreme cases, oversupply can lead to a drop in the value of tokens.

Market Cap:

An organization’s market cap or capitalization is the sum of all coins they have launched by developing it and multiplying it by the number of coins in circulation.

When a project’s entire supply of tokens is available for trading, it is called a fully diluted market cap, and it gives you an idea of the value that investors are placing on these projects. The smaller the supply of tokens and the greater their demand, the more valuable they can potentially be.

Crypto’s future value:

An essential part of any blockchain project is considering the tokenomics model includes factors such as exchange rate, leveraging tokens on volatility, pegging to fiat currencies, or issuing utility tokens. Creating a well-devised tokenomics plan can take your project far in ensuring success!

You now understand that Tokenomics involves designing and disseminating valuable digital tokens. Therefore, every industry can benefit from tokenomics (entrepreneurs, developers, and creators). NFTs are unique. They have been trending lately and have sparked a lot of interest in tokenomics, especially among NFT bids and auctions. Tokenization of property, art, collectibles, and assets is a new way of digital ownership that also showcases the potential in this area. NFTs will dominate tokenomics in the future. Unlike cryptocurrencies like Bitcoin, NFT tokens create digital scarcity; each token is unique and valued accordingly. Whether planning an ICO or thinking of a crypto-related business move, it’s essential to understand the basics of tokenomics. BloxBytes has a comprehensive understanding of tokenomics, which we use to develop lucrative blockchain projects and deliver blockchain consulting services to clients. Furthermore, we support you in adding significance to your business model by designing smart, scalable token solutions that are ready for the future of Blockchain.