Introduction

Web3 & Blockchain Consultancy :

How to Make Money With Smart Contracts: Complete Guide

One phrase has gained prominence in the constantly transformative field of blockchain technology: smart contracts. This technology offers financial opportunities as well as innovative possibilities to both individuals and businesses. The way transactions happen in the digital world is being altered by these self-executing, code-based agreements. In blockchain, there is more than just lines of code; that stands for security, trust, and—above all—a means of making money. Also, learn about blockchain smart contracts, their use cases, and real-world examples. How to Make Money With Smart Contracts is your guide to navigating how these automated contracts work. Let’s unravel the complexities and reveal the lucrative possibilities that smart contracts offer.What Are Smart Contracts?

- Self-executed contracts: Without the need for middlemen, smart contracts carry out the operations outlined in their code automatically. By doing this, the possibility of human error is eliminated and the terms of the contract are upheld.

- Trust: Blockchain technology, which is tamper-proof and transparent by nature, is the foundation upon which smart contracts are built. Because all parties can independently confirm the contract’s execution and results, this transparency fosters trust.

- Automation: A variety of tasks, including intricate business logic and financial transactions, can be carried out automatically by the code contained in smart contracts. Operations are streamlined and less manual intervention is required thanks to this automation.

Examples of smart contract applications

- Financial Services: Token swaps, decentralized finance (DeFi) protocols, and automated lending and borrowing are all made possible by smart contracts.

- Supply Chain: They guarantee product traceability and transparency, which lowers fraud and errors.

- Real estate: Smart contracts can help with property transactions by transferring ownership automatically upon fulfillment of payment terms.

- Insurance: Automating the processing and payment of claims can improve productivity and cut down on overhead.

Smart Contracts Cash Flow

Smart contracts are a route to financial optimization; they’re more than just cutting-edge technology. Moreover, their capacity to optimize processes, minimize expenses, and guarantee automated, flawless transactions is revolutionary for both individuals and enterprises striving to enhance their financial stability. Now let’s explore the financial smart contracts benefits they offer:- Financial Gains: The possibilities for financial gains are endless with smart contracts. Numerous processes can be automated to generate income and save a substantial amount of money. Furthermore, these advantages can be applied to a variety of industries rather than just one.

- Automated Payment Processes: The ability of smart contracts to automate payment processes is one of their most notable features. Smart contracts guarantee that money is transferred automatically when specified conditions are fulfilled for any kind of financial transaction, including salary payments, royalty distributions, and other similar transactions. As a result, this automation lowers the possibility of payment errors while also saving time.

- Minimizing Intermediaries: In many cases, smart contracts can replace the need for middlemen in transactions. As a result, they eliminate the related costs and possible points of failure by doing this. The financial bottom line may be significantly impacted by this cost reduction, which also increases transaction effectiveness and efficiency.

- Cost reductions and efficiencies gains: Administrative costs and inefficiencies are nothing new in the financial sector. Head-on, smart contracts deal with these problems. They lessen the requirement for paperwork, human oversight, and expensive middlemen. Consequently, this improves productivity, simplifies procedures, and results in substantial financial savings.

Smart Contracts Development

Let us examine the steps involved in implementing these digital agreements:- The Creation Process: Blockchain technology is used to build a smart contract. Determining the terms and conditions of the contract is the first step in the process. This entails detailing the parties to the agreement, the circumstances under which it will be carried out, and the steps that must be taken when it is fulfilled. The contract is then encoded in a programming language appropriate for the selected blockchain after these parameters have been established.

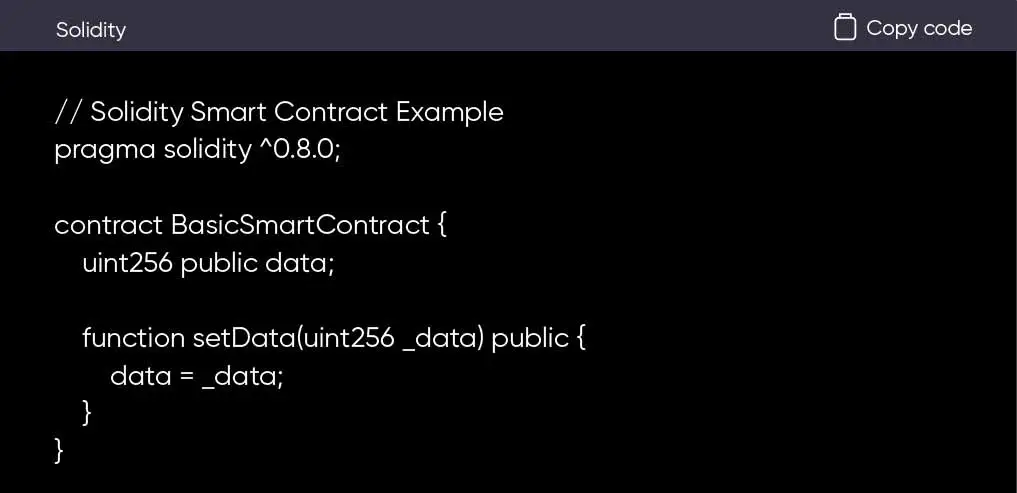

- Programming Languages: Certain programming languages are relevant to the development of smart contracts. For example, Solidity is primarily used by Ethereum, one of the most widely used blockchain platforms for smart contracts. The language Solidity is used to create Ethereum smart contracts. It provides the structures and tools required to specify the logic, information, and operations of the contract. It’s important to select the appropriate language for your platform as different blockchains might have different preferences.

- The Significance of Security: When developing smart contracts, security is a crucial factor to take into account. These agreements automate vital procedures and deal with priceless assets. Any weakness or vulnerability in the contract’s coding may result in monetary losses or other unfavorable outcomes. As a result, in-depth testing and auditing are necessary to find and fix any security vulnerabilities. Furthermore, in order to guarantee the reliability of the smart contract, compliance with established security guidelines and best practices is essential.

Build a Smart Contract

Although creating a simple smart contract might seem difficult, the following steps will help novices get started:- Define the Contract: Start by outlining your contract’s terms and conditions. What steps should the contract take to execute, and under what circumstances will it do so?

- Pick a Blockchain: For your smart contract, pick a blockchain platform. Popular options include Ethereum, Binance Smart Chain, and others.

- Select a Language for Programming: Choose the right programming language for the blockchain that you have selected. Solidity is frequently utilized with Ethereum.

- Write the Code: Compose the smart contract’s code. Add the functions, data, and logic that specify its behavior.

- Implementation and Testing: Thoroughly test your smart contract to find and address any problems. After it’s secure and fully tested, deploy it to the selected blockchain.

- Interact with the Contract: Interact with your deployed smart contract using blockchain wallets or applications. For example, you can call the setData function in the above example to set the data value.

Real-World Examples of Smart Contracts

As businesses and individuals continue to discover innovative applications, the income-generating potential of smart contracts evolves and expands. Let’s have a look at some noteworthy examples:- DeFi Platforms: Platforms like Compound and Aave enable users to lend or borrow assets, earning interest in the process. By utilizing smart contracts, these platforms have become key players in the DeFi space.

- NFT Marketplaces: NFT marketplaces, such as OpenSea, provide a platform for artists to sell their digital creations. Smart contracts automate the minting and trading of NFTs, creating opportunities for artists to monetize their work directly.

- Supply Chain Solutions: Businesses like IBM Food Trust utilize smart contracts to enhance the transparency and traceability of products in the supply chain. This not only reduces errors but also provides opportunities for cost savings and process optimization.

- Decentralized Autonomous Organizations (DAOs): DAOs are organizations governed by smart contracts. Members make decisions and vote on proposals using blockchain-based tokens. DAOs enable community-driven decision-making. Some have generated income through collective investments or product development.

- Insurance: The insurance industry has embraced smart contracts for automated claims processing. When specific conditions are met (e.g., flight delays or adverse weather events), smart contracts trigger automatic payouts. As a result, this reduces administrative costs and improves the efficiency of insurance services.

- Real Estate: Property transactions often involve intermediaries and complex contracts. Smart contracts simplify this process by automating the transfer of ownership upon the fulfillment of predefined conditions. Platforms like Propy use smart contracts to facilitate real estate transactions, reducing the need for intermediaries and associated costs.

- Tokenization of Assets: Smart contracts allow the fractional ownership of assets, such as real estate or artwork. Platforms like RealT tokenize real estate, enabling investors to purchase a fraction of a property. As a result, this opens up investment opportunities in traditionally illiquid assets.

- Content Creators: Smart contracts are revolutionizing how content creators monetize their work. Platforms like Audius and Rarible enable musicians and artists to directly sell their content as NFTs, ensuring creators receive a fair share of the revenue and royalties when their work is resold.

- Cross-Border Payments: Companies like Ripple use smart contracts to facilitate cross-border payments, reducing fees and transaction times. These smart contracts ensure that funds are released only when predefined conditions are met.

How to Make Money With Smart Contracts

Smart contracts are a gateway to diverse income-generation opportunities, with some users achieving significant financial gains. Let’s delve deeper into these avenues, providing facts and interesting insights:Yield Farming:

- Yield farming is like the high-yield savings account of the crypto world. Users provide liquidity to DeFi protocols, locking their assets into smart contracts, and in return, they earn interest, fees, or governance tokens.

- Compound, a DeFi lending platform, attracted millions of dollars in assets within days of launching its governance token, COMP.

- Users who supplied assets to Compound’s liquidity pools received COMP tokens as a reward, kickstarting the yield farming trend.

Liquidity Provision:

- Liquidity providers play a pivotal role in the operation of decentralized exchanges (DEXs).

- They add funds to liquidity pools, enabling traders to make instant swaps, and, in return, they earn a portion of the trading fees.

- Uniswap, one of the most popular DEXs, allows users to provide liquidity to various pools.

DeFi Opportunities:

- Decentralized finance applications have blossomed, offering a wide range of income-generating options.

- Users can engage in lending, borrowing, staking, yield farming, and liquidity provision, all facilitated by smart contracts.

- Users can earn interest on deposited assets and borrow crypto by collateralizing their holdings, illustrating the immense growth in DeFi lending.

Revenue Streams and Potential Risks:

- Smart contracts enable various revenue streams, including transaction fees (gas fees), interest on locked assets, and token rewards.

- Yield farming strategies may combine multiple streams to maximize earnings.

- However, risks abound in the DeFi space. Smart contract vulnerabilities can lead to exploits and losses.

- Market volatility can impact asset values, and regulatory changes can introduce uncertainty. It’s crucial for participants to conduct due diligence and manage risk effectively.

- The DeFi landscape continues to evolve, offering innovative opportunities and rewards for those willing to explore its potential.

- While income generation is a central theme, it’s important to approach these opportunities with a clear understanding of the associated risks and a commitment to staying informed about this dynamic and ever-changing ecosystem.

Considerations

When venturing into the world of smart contracts, it’s imperative to be aware of the potential risks and vulnerabilities. Here, we address these considerations and offer guidance for safe and informed participation:- Security Vulnerabilities: Smart contracts are not immune to vulnerabilities. Coding errors, known as “bugs,” can be exploited, potentially leading to financial losses. High-profile incidents, such as the infamous DAO hack, have demonstrated the real risks associated with smart contracts.

- Risk Mitigation: To mitigate risks, it’s important to follow best practices in smart contracts development. In addition, this includes thorough code audits, extensive testing, and adherence to standardized security guidelines. Furthermore, engaging with platforms that provide audited smart contracts can enhance security.

- Due Diligence: Before participating in any smart contract-based activities, conduct thorough due diligence. This includes researching the project, understanding the contract’s functions, and assessing the associated risks. Engaging with communities and seeking expert advice can also provide valuable insights.

Future Trends in Smart Contracts

- Scalability: As more users and businesses adopt blockchain technology, the capacity to process a large number of transactions efficiently is becoming increasingly crucial. Layer 2 solutions and blockchain upgrades are being explored to address this issue. BloxBytes is known as the leading blockchain development services provider as their offerings include layer 1 and layer 2 blockchain development services and also they provide assistance to those who don’t know where to start or who are already stuck.

- Interoperability: The ability of smart contracts to interact seamlessly with different blockchains is a key focus. Projects like Polkadot and Cosmos are pioneering interoperable blockchain ecosystems that enable smart contracts to function across multiple chains, expanding their utility and reach.

- Regulatory Developments: Governments and regulatory bodies are beginning to formulate guidelines and regulations for blockchain and smart contracts. The evolving regulatory landscape will impact how smart contracts are used in various industries and could introduce new compliance requirements.