Introduction

Web3 & Blockchain Consultancy :

How Much Does it Cost To Create a Stock Trading App

Creating trading apps for stocks and other financial instruments has become increasingly popular among finance startups, consumer banks, and investment banks. As everyone seeks to introduce innovative business models and capture a portion of the profits generated by mobile trading apps, the development process has grown more intricate and expensive. Here is a breakdown of what goes into developing trading apps and their associated costs.Key Takeaways

- Trading app development is complex and can vary significantly in cost based on feature complexity and design.

- Basic trading apps require 3 to 6 months for development with costs ranging from $50,000 to $200,000.

- Advanced trading apps like Robinhood demand 12 to 16 months or more, with expenses ranging from $500,000 to $1,500,000.

- Costs escalate with the addition of advanced features, high-quality UI/UX, security measures, and compliance with regulations.

- Choosing between in-house and outsourced development affects both the cost and the timeline of the project.

- Bloxbytes is a blockchain development company that can develop robust, feature-rich trading apps tailored to client needs.

What is a Trading Application?

A trading application, also known as a stock brokerage app, is an online platform that allows users to buy and sell assets such as stocks, securities, currencies, ETFs, and more using their mobile phones and computers. But there’s more to it than just that. Trading applications offer extensive features to enhance the trading experience. They provide real-time updates from the stock market through an easy-to-understand stock ticker, manage investment portfolios, and support automated trading features like stop/loss systems. Essentially, these apps put the entire stock market in the palm of your hand.Popularity of Trading Apps

In recent years, trading apps have dramatically transformed the financial markets. This shift began with the advent of mobile technology. In the early 2010s, the first trading apps emerged, offering unprecedented access to the stock markets directly from smartphones. Among these pioneering apps, Robinhood quickly made a name for itself, revolutionizing the market with its no-fee trading policy and user-friendly interface. Current market statistics reveal that Robinhood has a significant following of approximately 16 million users. This figure underscores the widespread appeal of trading apps among investors from various backgrounds. The rapid growth in popularity of these apps reflects the increasing demand in today’s digital age for straightforward and accessible investment platforms.Factors Affecting Development Costs

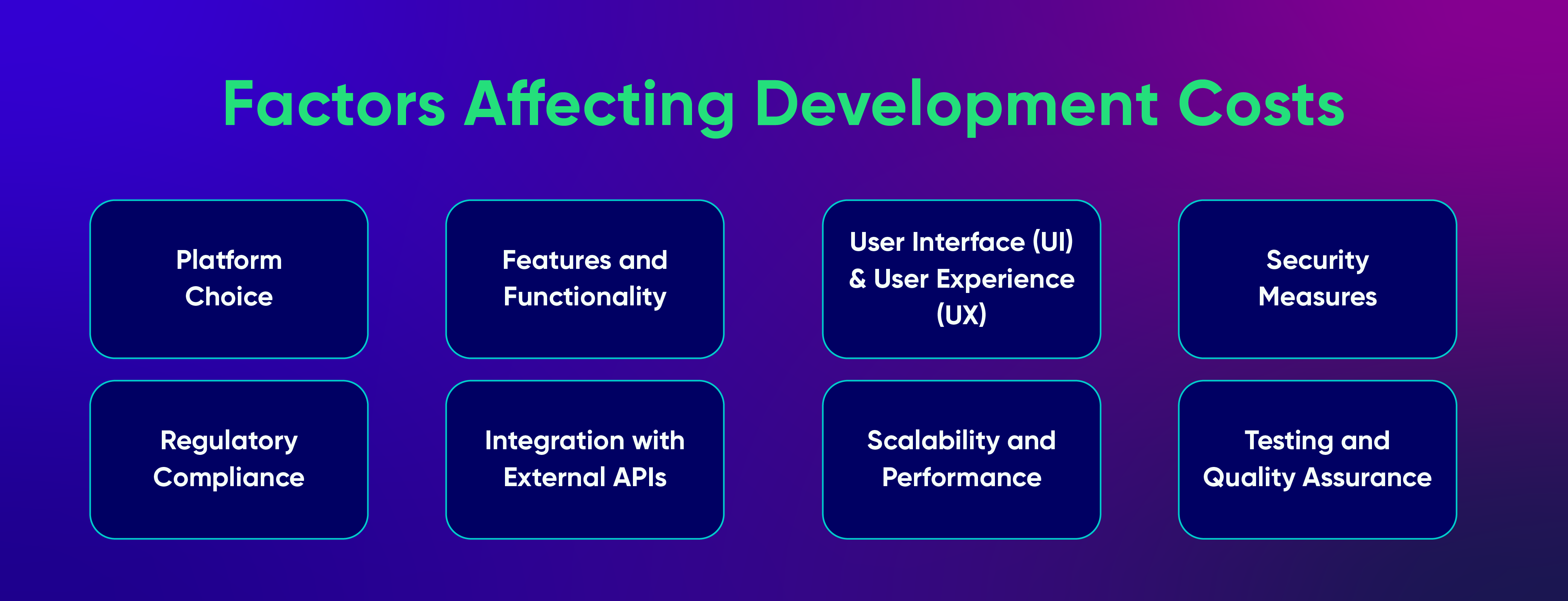

Platform Choice

Building an app for both iOS and Android increases the time and money needed compared to just one platform. Choosing a development framework like React Native or Flutter also affects costs. You might want to explore the expenses of developing with Flutter to make an informed choice.Features and Functionality

The complexity and quantity of features directly influence the cost of development. Adding sophisticated features like live market updates, detailed charting tools, and social networking capabilities takes more effort and resources, which raises costs.User Interface (UI) and User Experience (UX)

Investing in top-notch UI/UX design improves user satisfaction but also increases development costs. Designing easy-to-use interfaces, carrying out user research, and refining design prototypes all come with extra expenses.Security Measures

Incorporating strong security measures is crucial but costly. Features such as encryption, secure login systems, and adherence to regulatory standards require specialized knowledge and resources.Regulatory Compliance

Complying with financial regulations and data protection laws adds to the complexity and expense of development. Developers need to spend time and resources to understand and integrate these requirements, conduct audits, and acquire the necessary licenses or certifications.Integration with External APIs

Connecting with third-party APIs for market data, trading functions, and payment processing requires extra work and costs. There might be licensing fees, API usage costs, or expenses for custom integration solutions. Check out our API development services to understand how API integration can impact app development.Scalability and Performance

Creating a scalable and high-performing trading app involves investments in infrastructure, backend systems, and optimization strategies. Ensuring the app can manage large user numbers, process transactions rapidly, and expand smoothly with increasing demand leads to higher costs.Testing and Quality Assurance

Committing to comprehensive testing and quality assurance is essential but increases development expenses. Testing across various devices, platforms, and settings, along with security checks and performance tests, demands dedicated time and resources. Explore our load-testing services to see how software testing can enhance app performance.Development Timeline and Costing

The expense of creating your trading app is tied directly to the duration of development and your developer’s hourly wage; in other words, the total cost is calculated as the development time (in hours) multiplied by the hourly wage of your developers. It’s crucial to establish and follow a timeline for your app’s development phase.Basic Trading App

- Expected Development Duration: 3 to 6 months

- Total Development Hours: Roughly 480 to 960 hours

- Intermediate Trading App:

- Expected Development Duration: 6 to 12 months

- Total Development Hours: Roughly 960 to 1920 hours

Advanced Trading App

- Expected Development Duration: 12 to 16 months or longer

- Total Development Hours: About 1920 hours or more

Types of Trading Apps and Their Costs