Introduction

Blockchain & Web3 Services Trusted By Leaders

- Develop innovative solutions using our state-of-the-art blockchain expertise.

- Achieve accelerated growth with robust & scalable Web3 consulting.

- Unlock 360-degree security with our top-rated blockchain development.

What Is the Difference Between Radium and Radium CPMM Crypto?

Cryptocurrency is a constantly changing field filled with a variety of coins, tokens, and platforms, each offering distinct characteristics and functions. For newcomers and experienced followers alike, it can be difficult to differentiate among the various kinds of cryptocurrencies. A frequent source of confusion lies in recognizing the differences between Radium and Radium CPMM crypto. Let’s explore what each of these are and how they are distinct from one another.Key Takeaways

- Radium is a digital currency that operates on the Solana blockchain, supporting trading, staking, and reward generation.

- Radium CPMM, a Constant Product Market Maker, is employed to manage pricing and liquidity on decentralized exchanges.

- Radium crypto is available on several major exchanges, including Binance and FTX, facilitating broad accessibility.

- The primary difference between Radium and Radium CPMM is that Radium is a token used for transactions, while CPMM is a mechanism for pricing and liquidity management.

- Radium offers yield farming where users can stake tokens for additional rewards, enhancing earning potential within the platform.

What is Radium?

Radium crypto plays a key role in the decentralized finance (DeFi) ecosystem of the Solana blockchain, functioning as a comprehensive automated market maker (AMM) platform. Radium crypto provides a suite of DeFi services designed to simplify cryptocurrency trading, enhance liquidity, and offer yield-generating opportunities. Its main functions include enabling users to swap various digital assets, contribute to liquidity pools, and participate in governance decisions that shape the future of the protocol. As an AMM, Radium crypto eliminates the need for traditional order books by using smart contracts to manage liquidity pools. These pools contain pairs of tokens, allowing users to trade directly using the liquidity provided by others. This setup ensures that liquidity is always available for trading, even for less popular token pairs, significantly reducing barriers in the trading process.Role of Radium on the Solana Blockchain

Radium’s integration into the Solana blockchain is crucial for its identity and functions. Solana’s ability to handle many transactions quickly and with minimal delay provides the ideal environment for Radium to execute transactions almost instantly and at a low cost. This effective collaboration between Radium and Solana tackles a major challenge in the DeFi sector: scalability. By utilizing the strengths of Solana, Radium is capable of handling thousands of transactions per second, much cheaper than Ethereum-based decentralized exchanges. This not only improves the overall user experience but also enables more frequent trading and sophisticated DeFi tactics that were not feasible before due to the slow speeds and high costs on other blockchains.Features of Radium

Radium offers a wide range of features to address the varied needs of users in the DeFi space:- Token Swapping: Radium allows users to effortlessly exchange one token for another through its easy-to-use interface. The platform supports a wide variety of tokens from the Solana ecosystem, giving users many trading options.

- Liquidity Provisioning: Users can become liquidity providers by adding pairs of tokens to Radium’s pools. They earn a share of the trading fees collected from the pool, providing them with a way to earn passive income.

- Yield Farming: Radium provides opportunities for yield farming, where users can stake their liquidity provider tokens to gain extra rewards, typically in the form of the platform’s native token.

- Governance: Holders of Radium’s governance token can participate in the protocol’s governance by voting on proposals. These proposals range from changes in fee structures to the introduction of new platform features.

- Cross-chain Bridging: Radium has implemented bridging solutions that allow users to transfer assets between Solana and other blockchain platforms, enhancing the platform’s accessibility and functionality.

- What is Radium CPMM?

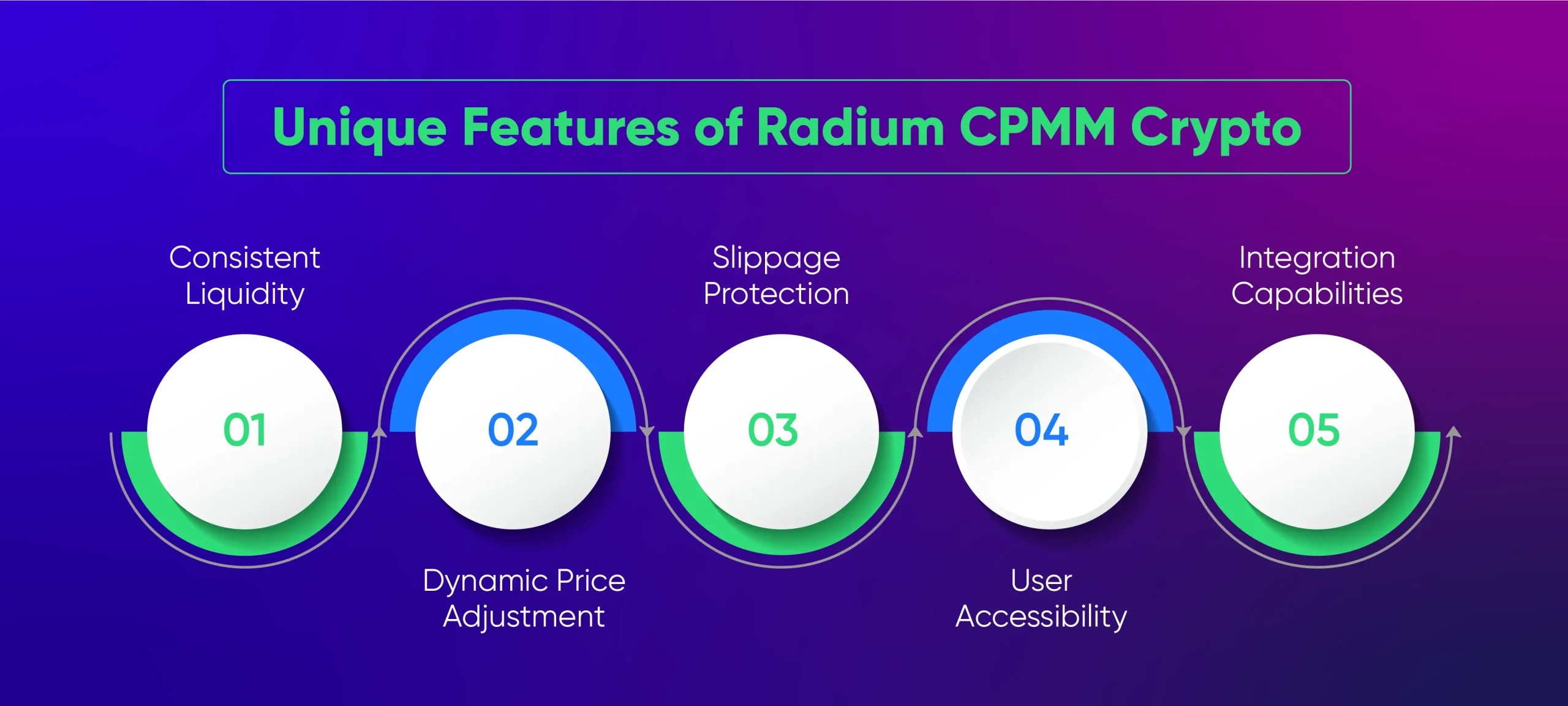

Unique Features of Radium CPMM Crypto

Radium CPMM has several distinct features that set it apart in the Automated Market Maker (AMM) landscape:

- Consistent Liquidity: The CPMM model ensures there is always liquidity available for trading, regardless of market changes or transaction sizes.

- Dynamic Price Adjustment: As transactions occur, the CPMM automatically adjusts prices based on supply and demand, ensuring efficient price setting without the need for external price feeds.

- Slippage Protection: The model naturally protects against significant price slippage by making larger trades more expensive, which helps prevent price manipulation.

- User Accessibility: The basic nature of the constant product formula is easy to understand and use, making it friendly for both users and developers.

- Integration Capabilities: The simplicity of the CPMM model allows for easy integration with other decentralized finance (DeFi) protocols, enhancing collaboration within the ecosystem.

Benefits of Using Radium CPMM Crypto

The use of the CPMM model within Radium offers several advantages for users and the broader DeFi community:- Predictable Pricing: The mathematical structure of the model allows users to accurately predict trading outcomes, enabling better-informed decisions.

- Reduced Impermanent Loss: While it cannot completely eliminate impermanent loss, the CPMM approach helps lessen this risk for liquidity providers compared to some other AMM systems.

- Enhanced Capital Efficiency: Radium CPMM focuses liquidity near the current market price, improving how effectively capital is used by liquidity providers.

- Arbitrage Opportunities: The model naturally creates opportunities for arbitrage, which helps keep prices consistent across different markets and exchanges.

- Flexibility: The CPMM model is easily adaptable to various token pairs and pool configurations, offering a broad range of trading options.

The main difference between Radium and Radium CPMM Crypto

Grasping the key differences between Radium and Radium CPMM Crypto reveals their distinct roles within the cryptocurrency world. After reviewing what each entails, we can pinpoint their differences.Purpose and Function

- Radium acts as a digital currency, which means it can be traded, staked, or used in various DeFi applications.

- Conversely, Radium CPMM isn’t a currency but a tool or mechanism used within the Radium platform to improve trading efficiency.

Usage

- Radium serves as a token for trading, staking, and earning rewards. Owners of Radium can also participate in governing the platform, influencing key decisions.

- Radium CPMM works in the background. It helps set token prices on the Radium platform by balancing supply and demand.

Accessibility

- Radium tokens are widely accessible. They are available on many exchanges and compatible with various wallets.

- Radium CPMM, essential for the platform’s operation, doesn’t interact directly with users. It functions automatically within the system.

Complexity

- Interacting with Radium is straightforward. Like many cryptocurrencies, you can buy, sell, and stake it.

- Understanding Radium CPMM requires more in-depth knowledge of how decentralized exchanges operate. It is a complex part of the Radium platform.

Function within the Ecosystem

- Radium enhances the DeFi ecosystem by enabling trading and opportunities to generate income.

- Radium CPMM ensures smooth and efficient transactions on the Radium platform, managing the entire trading process.

Why Both are Important

Both Radium crypto and Radium CPMM crypto are crucial for the smooth functioning of the Radium platform. Radium serves as the primary token, powering the platform, while Radium CPMM ensures that trading is fair and efficient. Understanding both elements allows users to fully utilize what Radium has to offer.How to Use Radium

Using Radium is simple. Follow the steps given below:- Get a Wallet: First, secure a crypto wallet that supports Solana-based tokens.

- Buy Radium: Purchase Radium from popular exchanges like Binance or FTX.

- Trade or Stake: Once you have Radium, you can trade it for other tokens or stake it to receive rewards.

- Participate in Governance: Holding a sufficient amount of Radium allows you to vote on decisions affecting the platform.

Common Mistakes in Radium Trading

New traders in the Radium market should be aware of common pitfalls that could affect their trading success. One common mistake is not doing enough research before trading. Failing to assess market trends or investigate the assets involved can lead to hasty and costly decisions. Additionally, ignoring the potential for impermanent loss when providing liquidity is another oversight. Traders should weigh the risks related to market changes and invest only what they can afford to lose. Establishing definite plans for exiting investments can also help lessen the impact of market downturns.Misunderstanding CPMM Mechanics

Not fully understanding CPMM mechanics can lead to poor trading strategies. Traders need to familiarize themselves with how the constant product formula works and realize how their trades impact liquidity pools. Not considering the effects of large trades can cause significant price changes, reducing profits. Furthermore, understanding the role of fees within Radium CPMM is crucial. Traders should consider transaction costs when evaluating the profitability of a trade, especially for smaller transactions that may not cover the fees involved.Practical Uses of Radium and Radium CPMM