Introduction

Blockchain & Web3 Services Trusted By Leaders

- Develop innovative solutions using our state-of-the-art blockchain expertise.

- Achieve accelerated growth with robust & scalable Web3 consulting.

- Unlock 360-degree security with our top-rated blockchain development.

Cefi Vs Defi: Comparing the Features and Differences

Decentralized finance (DeFi) and centralized finance (CeFi) are two different approaches to financial services. DeFi is built on decentralized infrastructure, such as blockchain technology, and is open-source and community-driven. CeFi, on the other hand, is built on a centralized infrastructure and controlled by a centralized entity. This article compares and contrasts CeFi vs DeFi and discusses their features and differences. We will also look at current market trends and potential developments in the DeFi and CeFi space.What is CeFi?

Characteristics and features

1. Centralized infrastructure

A bank or other financial institution is in charge of all transactions and operations in CeFi, which means all transactions and operations are centralized.

2. Closed-source and proprietary

CeFi systems and platforms are typically closed-source and proprietary, meaning the source code is unavailable for public inspection or modification.

3. Controlled by a centralized entity

Typically a financial institution or government manages CeFi, making decisions and managing funds flow.

4. Custodial

CeFi often involves using custodial services, where a third party holds and manages assets on behalf of the customer. Customers need complete control over their assets and rely on the custodian to handle transactions and manage their investments.

5. Accessible only to users who pass KYC/AML checks

CeFi platforms and services are typically only accessible to users who have passed Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, which are put in place to prevent fraudulent activities.

Examples of CeFi applications

The following are some Centralized finance examples;1. Traditional banks:

Banks that operate physical branches offer a wide range of financial services, such as deposit accounts, loans, mortgages, and credit cards. Examples include JPMorgan Chase, Bank of America, and Wells Fargo.

2. Online payment platforms:

Individuals and businesses can make and receive payments electronically through websites and mobile apps. Examples include PayPal, Venmo, and Square.

3. Stock exchanges:

The trading of stocks and other securities takes place on centralized marketplaces. Examples include the New York Stock Exchange (NYSE), the NASDAQ, and the Tokyo Stock Exchange (TSE).

4. Centralized lending and borrowing platforms:

Online platforms allow individuals and businesses to lend or borrow money directly from other users rather than through a traditional financial institution. Examples include Lending Club, Prosper, and SoFi.

What is DeFi?

Decentralized finance, commonly known as DeFi, is a financial system built on decentralized infrastructure, such as blockchain technology. It is a rapidly growing field aiming to provide financial services without the need for centralized intermediaries, such as banks and governments. Accessibility, transparency, and decentralization are the core principles of DeFi. It uses smart contracts to automate financial transactions. In addition, decentralized and trustless financial services such as lending, borrowing, trading, and insurance are now possible with the creation of new financial instruments and markets.

Characteristics and features

1. Decentralized infrastructure

Blockchain technology is at the core of Defi services, which means it is decentralized, so no centralized organizations control it. Instead, it relies on a network of nodes that validate and record transactions. This decentralized architecture ensures that there is no single point of failure and that the system is more resilient to attacks and failures.

2. Open-source and transparent

Generally, DeFi applications are open-source, so that anyone can audit their codebase. These features enhance transparency and trust in the system, allowing anyone to verify the underlying code and ensure it functions as intended.

3. Community-driven

DeFi is a community-driven ecosystem where developers, users, and investors collaborate to build and improve upon the network. Collaboration creates a vibrant and dynamic ecosystem where new ideas and innovation can flourish.

4. Non-custodial

DeFi applications are generally non-custodial, meaning users have complete control over their assets and private keys. Unlike traditional financial systems where centralized mediators control assets and can be frozen or seized.

5. Accessible to anyone with an internet connection

DeFi is accessible to anyone with an internet connection, regardless of location or creditworthiness. Blockchain technology is the core technology behind this, which enables the creation of digital assets and decentralized exchanges that anyone can access.

Examples of DeFi applications

The following are some DeFi examples;1. Decentralized exchanges (DEXs)

A decentralized exchange (DEX) is a type of cryptocurrency exchange that allows for the buying and selling of digital assets in a trustless and decentralized manner. Users can trade directly without the need for a centralized intermediary. Some famous examples of DEXs include Uniswap, Sushiswap, and Kyber Network.

2. Lending and borrowing platforms

DeFi services like providing lending and borrowing platforms allow users to lend and borrow digital assets in a decentralized and trustless manner. DeFi platforms use smart contracts to automate the lending process and typically offer higher interest rates than traditional lending institutions. Some famous examples of DeFi lending platforms include Aave, Compound, and MakerDAO.

3. Stablecoins

Stablecoins are digital assets pegged to the value of a traditional currency, such as the US dollar. They provide stability in the DeFi ecosystem and serve as a medium of exchange, collateral, and remittance. Some famous examples of stablecoins include Tether (USDT), DAI, and USDC.

4. Yield farming

Yield farming has become a popular way to earn high returns on investment in the DeFi ecosystem. Yield farming refers to lending or staking digital assets to make a return on your investment. This process is typically done by depositing assets into a liquidity pool, which can enable trading on a decentralized exchange, or by staking assets in a proof-of-stake network.

CeFi vs DeFi

A. Similarities and Differences:

- CeFi (Centralized Finance) and DeFi (Decentralized Finance) are digital finance forms that use technology to provide financial services.

- CeFi and DeFi can offer similar services, such as lending, borrowing, and digital trading assets.

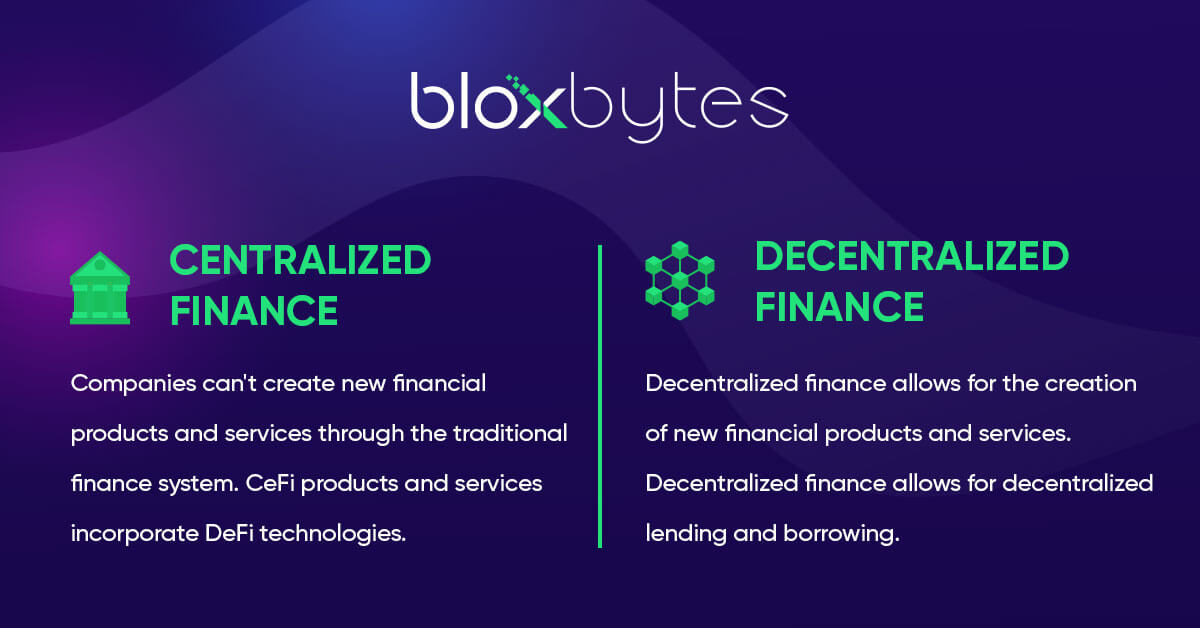

- The main difference between CeFi and DeFi is the degree of centralization. CeFi relies on centralized intermediaries such as banks or online payment platforms. At the same time, DeFi is built on decentralized networks such as blockchain and smart contracts, allowing for trustless transactions and greater user autonomy.

B. Current market trends:

- The DeFi market has seen rapid growth in recent years, with the total value locked in DeFi reaching billions in 2022.

- CeFi, on the other hand, has a more established market, with traditional banks and financial institutions dominating the space.

- However, there is an increasing trend of CeFi companies experimenting with DeFi technologies and incorporating them into their products and services.

C. Potential future developments:

- The DeFi market has the potential to grow as blockchain technology and decentralized finance become more mainstream.

- CeFi companies may adopt more decentralized technologies to improve their services and offer new products.

- There may be a growing trend of interoperability between CeFi and DeFi, allowing for seamless integration of services between the two.

- The regulatory landscape for DeFi may also evolve, leading to greater legal clarity and protection for users.