Introduction

Web3 & Blockchain Consultancy :

Building a Crypto Trading Bot – Your Easy Step-by-Step Guide

Anyone can use third-party platforms to automate trades, but have you ever considered creating your own crypto trading bot? While many rely on proprietary software for trading automation, building your own can avoid unnecessary risks and limitations. A crypto trading bot not only saves time but also performs transactions more efficiently and swiftly than a human can. These bots are excellent for handling repetitive tasks and can trade on your behalf even when you’re asleep. Additionally, using a trading bot can deepen your understanding of the trading markets. Here’s a straightforward guide on how to develop your own crypto trading bot, but let’s first understand what crypto trading is and how crypto trading bots work.Key Takeaways

- Crypto trading bots automate the trading process, executing trades based on predefined rules and algorithms, which enhances efficiency and speed.

- The profitability of trading bots largely depends on the robustness of the underlying strategy and programming.

- Individuals can either build their own crypto trading bots with sufficient programming skills or hire professionals to create customized bots.

- The primary risk with crypto trading bots is the potential for significant financial loss due to market volatility and the limited capacity of bots to analyze complex market sentiments.

- Despite the risks, the demand for crypto trading bots is growing, driven by their potential to maximize profits in the right conditions.

Introduction to Crypto Trading

About ten years ago, cryptocurrencies burst onto the scene, yielding substantial profits for early investors and introducing the world to the idea of decentralized, unsupervised currencies. Currently, the total value of transactions in the global crypto market stands at approximately $1.3 trillion, with the industry experiencing a staggering annual growth rate of over 30%. In 2023, the global crypto trading volume surpassed $5 billion, and despite the prolonged downturn from 2022 to 2023, known as the crypto winter, the outlook remains positive. These figures suggest significant potential for growth and profit in crypto trading for those who are strategic and adept at managing risks. However, it’s important to note that the crypto market is vastly different from the traditional stock market. Here, cutting-edge technology governs all aspects of trading. This is where crypto bots become valuable. A crypto bot is a program or algorithm that automatically executes trades in the cryptocurrency market on behalf of its user. Most contemporary bots are powered by AI, enabling them to make rapid decisions based on complex and evolving sets of data.How Do Crypto Trading Bots Work?

Simply put, a crypto trading bot is an algorithm that executes trades based on specific, pre-set indicators and rules. These bots range from basic to highly sophisticated and costly. The developer inputs criteria for executing trades into the algorithm, which then continuously analyzes market data to identify the right conditions for placing buy or sell orders.Key Benefits of Using Cryptocurrency Trading Bots

Investing in or creating a cryptocurrency trading bot is a smart move for those looking to automate their trading or test new strategies through backtesting.- Speed: Bots can execute numerous transactions per second, which is impossible for humans. This allows them to generate profits continuously without the need to monitor the markets all day and night.

- Emotion-Free Trading: Unlike human traders who might make decisions based on emotions, bots operate solely on objective data, avoiding irrational choices.

- Automation: Bots operate 24/7 since they require neither rest nor sleep, enabling them to make profits while you relax.

- In-depth Market Analysis: Most bots, being AI-powered, are capable of performing real-time, comprehensive analyses of vast market data and make trading decisions based on the latest information.

- Main Strategies for Crypto Trading Bots

- Scalping: These bots execute many trades on small price variations, capitalizing on the inherent market volatility. This strategy is particularly effective when applied to building a Bitcoin trading bot on a well-known exchange with strong liquidity.

- Reversal Trading: These bots detect early indicators of a trend reversal and initiate trades in the opposite direction of the current trend.

- Momentum Trading: This involves bots trading in line with a strong price movement, either up or down.

- Arbitrage: Crytp arbitrage bots spot price discrepancies across different platforms and engage in cross-platform trades to achieve a solid return on investment.

- Market Making: Market-making bots profit from the price gap between selling and buying orders. This strategy is most effective with assets that have low volatility.

- News Trading: These bots monitor news outlets for potential market-moving information and make trades based on anticipated price changes.

How to Build a Crypto Trading Bot?

Once you decide to create your own crypto trading bot, you have two main paths:- Purchase or rent a pre-made bot (or find a free, open-source version online).

- Develop a custom bot with the assistance of skilled developers.

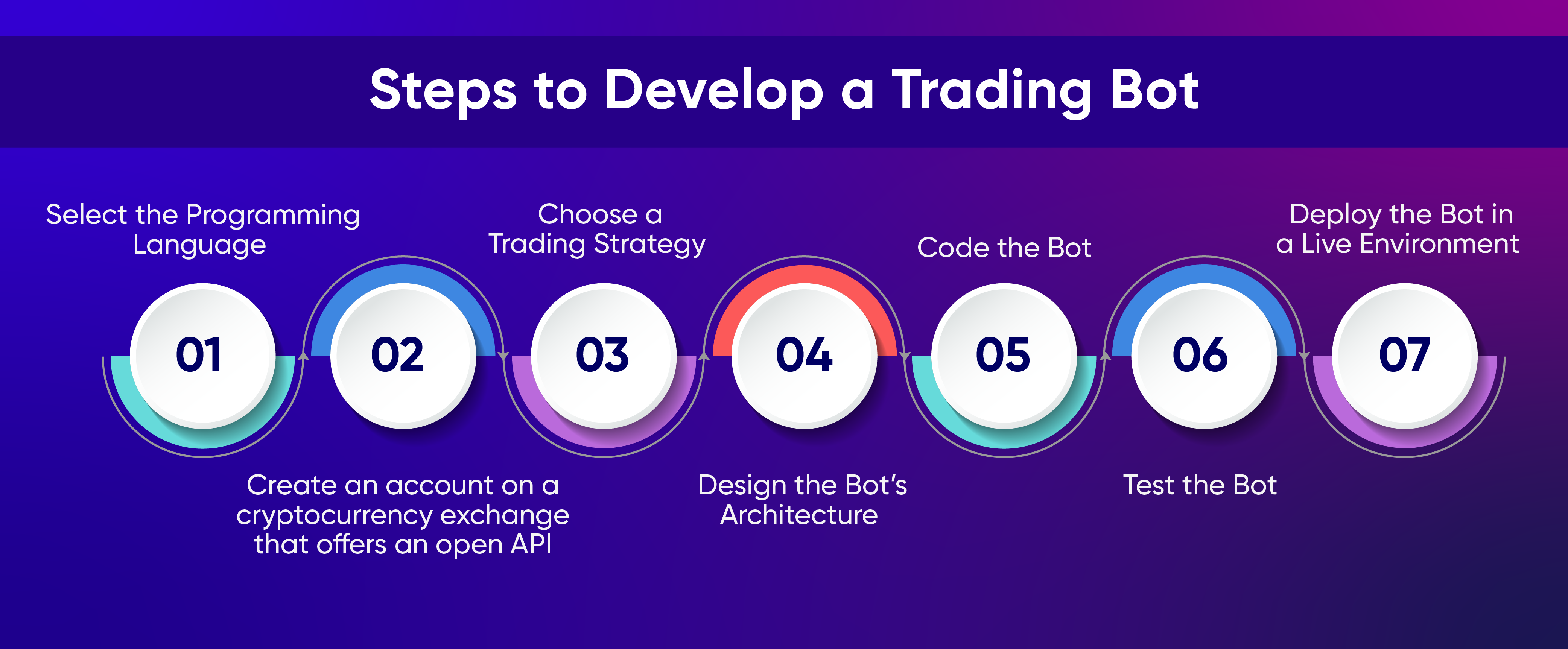

Steps to Develop a Trading Bot

Select the Programming Language

There are several programming languages suitable for creating a crypto bot, such as Python, Perl, C, JavaScript, and Rust—the latter being favored for its speed and functionality. Choose the language that best suits your needs and find a qualified developer or team to bring your concept to life.Create an account on a cryptocurrency exchange that offers an open API.

You’ll need an account on a crypto exchange to deploy your bot. Ensure you set this up early, as most platforms require KYC verification to access full features. Verify that the exchange allows bot integration through an open API, as some platforms restrict this to prevent automated trading.Choose a Trading Strategy

From the various strategies discussed earlier, choose one that aligns with your goals. Define the specific tasks your bot will perform, whether it be arbitrage, market-making, or following trends, and communicate these requirements to your development team.Design the Bot’s Architecture

This stage involves mapping out your bot’s decision-making process. You’ll need to establish the algorithmic model and set parameters that will guide its trading actions.Code the Bot

Now, your developers will start coding the bot according to your specifications. Once completed, you’ll have a prototype ready for testing.Test the Bot

It’s crucial to backtest the bot to ensure it behaves as expected and aligns with your strategy. Test it under various market conditions to see how it manages risk and the type of returns it generates.Deploy the Bot in a Live Environment

After successful tests, deploy the bot on your live crypto exchange account. Keep in mind that like any software, your bot will need ongoing adjustments and tuning to maintain optimal performance.Things to Consider Before Creating a Crypto Trading Bot

Once you decide to build a crypto trading bot, it’s important to plan everything in advance. This will help ensure you get the desired results and avoid wasting money on unnecessary features or technologies.- Adopt a Technical Approach: Find a trustworthy development team, select the right technology stack, choose a secure cloud platform, and address cybersecurity concerns.

- Create a Plan: Develop a detailed roadmap that outlines essential milestones and timelines for tracking progress for both you and your developers.

- Check Developer Qualifications: It’s crucial to hire developers with the necessary expertise to ensure the bot functions correctly.

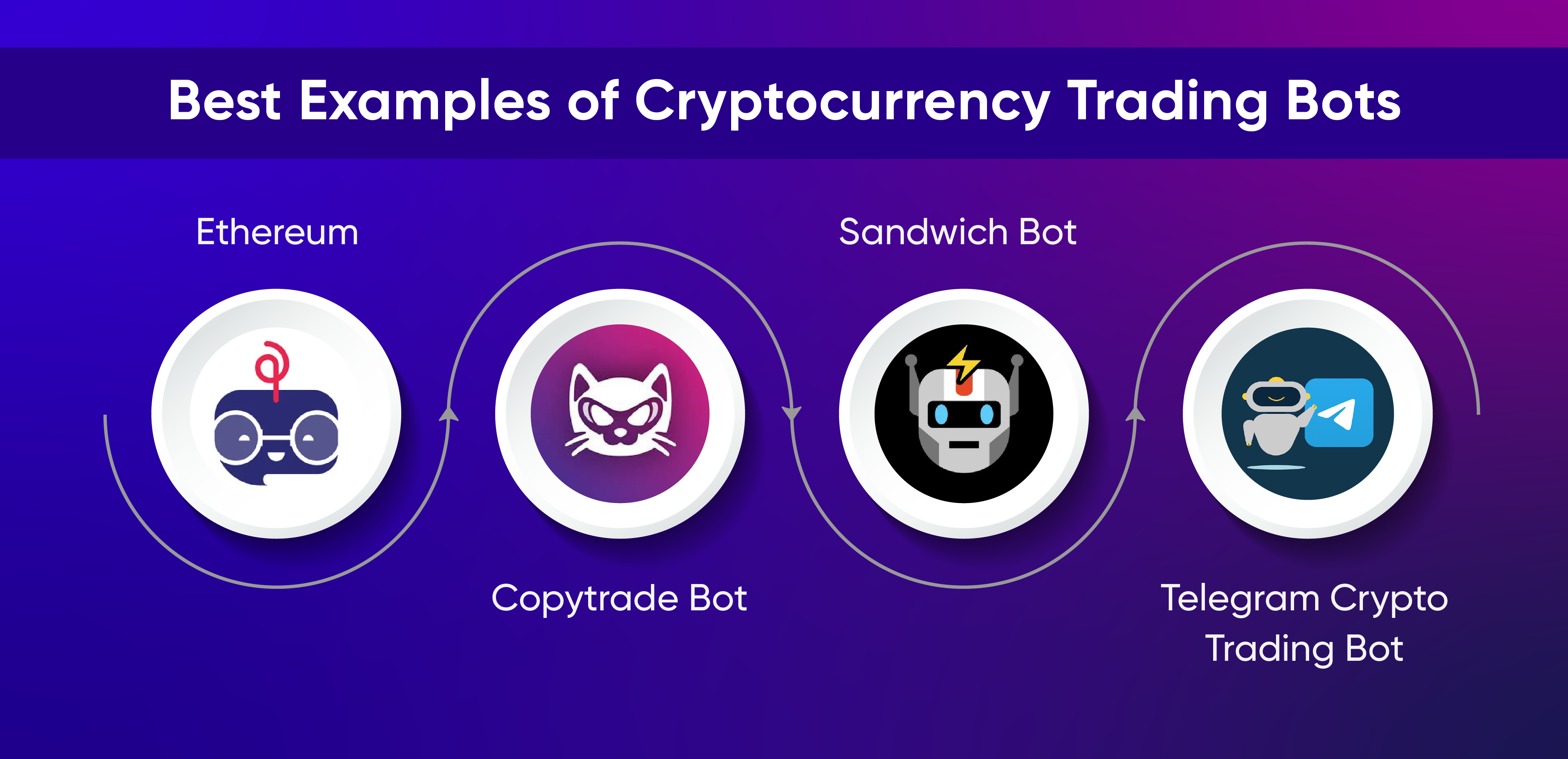

Best Examples of Cryptocurrency Trading Bots

While there are many crypto trading bots available, a few stand out for their effectiveness and innovation.

- Sniper Bot: Also known as a sniping bot, this software places bids at the last second in digital auctions or crypto trades. It evaluates all other bids and executes the final bid with high precision when specific conditions are met, often used on decentralized exchanges (DEX).

- Copy Cat/Copytrade Bot: These bots use back-running technology to replicate the trades of successful traders quickly, aiming to achieve similar outcomes. For example, a Uniswap trading bot can mimic the activities of successful traders on the platform.

- Sandwich Bot: This bot profits by monitoring buy and sell orders on crypto platforms and executing trades just before the next trade. It acts as a front running bot by taking advantage of traders’ prices, often preventing them from adjusting their trade settings.

- Telegram Crypto Trading Bot: With Telegram’s growing crypto compatibility, various bots have been developed to facilitate trading on multiple exchanges. Users can connect their accounts via API, allowing the bot to trade on their behalf. Additionally, Telegram crypto alert bots can notify users about specific asset prices, news, or events, providing a convenient and accessible solution directly from a smartphone.

Future Trends in Crypto Trading Bot Development

As blockchain technology rapidly evolves, several trends are shaping the future of crypto trading bots:- Increased Automation: With the accelerated integration of AI and machine learning (ML) into modern trading systems, future bots will likely offer enhanced adaptability, complexity, and sentiment analysis. The application of tools like Chat GPT for crypto trading demonstrates how AI complements this industry.

- Expanded Market Penetration: Bots are increasingly being used across various trading platforms, including traditional stock markets, DeFi projects, and other financial sectors, beyond just crypto platforms.

- Improved Risk Management: While current bots have limited risk management capabilities, future bots may offer more sophisticated risk adjustment features to protect users from market volatility.

- Enhanced Arbitrage: The development of effective cross-DEX arbitrage bots is underway. Although current bots perform cross-platform arbitrage, new technologies aim to improve their ROI and address existing inefficiencies.