Introduction

Web3 & Blockchain Consultancy :

Best AI Stock Trading Software – Revamp Your Investment Strategy

We are witnessing a lot of advancements happening in the domain of finance, with artificial intelligence (AI) revolutionizing the way we conduct transactions and financial operations. Now, this shouldn’t come as a surprise to you when I say that AI is also being utilized in the world of investing and stock trading. AI-powered stock trading software being developed today provides sophisticated tools that can analyze large volumes of data, make predictions, and even execute trades. This technology is shaping the future of trading by increasing efficiency, reducing human error, and enabling more strategic trading decisions. In this blog, we will explore some of the best AI stock trading software that are helping traders stay ahead in the competitive market of trading. Let’s first have a brief understanding of what AI stock trading is.What is AI-Powered Stock Trading Software?

AI trading software utilizes artificial intelligence technology to assist in the analysis and execution of stock trades. By leveraging algorithms that can interpret complex market data, these platforms can forecast market trends, automate trading decisions, and manage risks more effectively than ever before. Unlike traditional platforms, AI-driven tools continually learn and adapt, improving their predictions over time.Benefits of Using AI in Stock Trading

- Enhanced Accuracy: AI algorithms analyze historical data and real-time inputs to make highly accurate predictions about stock prices. This precision helps traders make informed decisions, minimizing the guesswork.

- Speed: AI trading bot processes and analyzes data much faster than human traders. This speed allows AI trading platforms to capitalize on opportunities that may come and go in seconds.

- Automated Trading: Traders can set specific criteria for trades, which AI software can execute automatically, ensuring opportunities are never missed even if the trader isn’t actively monitoring the market.

- Risk Management: AI software can predict potential downturns and volatility, helping traders manage and mitigate risks more effectively.

The Best AI Stock Trading Software

Let’s dive into an in-depth look at the best AI stock trading software currently available on the market.

TrendSpider – Enhanced Charting and Pattern Detection

TrendSpider is a comprehensive tool for analyzing financial charts, equipped with over one hundred technical indicators and a vast array of drawing tools. These functionalities allow traders to intricately design and execute their trading strategies. Moreover, TrendSpider offers an automated stock screener that efficiently scans numerous stocks to identify those that align with predefined user criteria. One of the key highlights of TrendSpider is its capacity for automated chart pattern analysis. It automatically performs calculations for Fibonacci sequences, identifies trend lines, recognizes candlestick patterns, and locates critical support and resistance levels. This level of automation frees traders from the mundane aspects of manual operations, enabling them to focus more on analyzing the charts rather than managing the software. Furthermore, TrendSpider facilitates the creation and operation of trading bots that require no coding. These bots carry out trades based on specific conditions set within the trading strategy. Additionally, TrendSpider enriches its offerings with a range of alternative data sources. Traders can access diverse market perspectives through tools like a news feed from Benzinga Pro, sentiment analysis derived from Reddit discussions, tracking of unusual options activity, and insights into stock transactions by company insiders.Trade Ideas – Advanced AI-Driven Stock Recommendations and Signals

Trade Ideas is custom-made for traders seeking enhanced insights into stock market dynamics. This platform not only includes the typical features expected of a stock monitoring and charting platform but also integrates advanced artificial intelligence capabilities. At the heart of Trade Ideas are AI-generated trading signals and recommendations. These signals provide a stock symbol along with advice on when to enter and exit trades. Premium users of Trade Ideas benefit from an AI-driven virtual assistant named Holly, who provides additional stock recommendations. The platform also includes a trading simulator, allowing users to test their trading strategies and automation setups in a risk-free environment. Trade Ideas seamlessly integrates with brokerage platforms such as Interactive Brokers and Tradezero, facilitating direct trading actions from within the platform. Trade Ideas offers a free membership tier that grants access to basic tools. For those requiring more advanced features, Trade Ideas provides two subscription options: a Standard plan priced at $84 per month and a Premium plan at $167 per month.Capitalise.ai – Simplifying Trading Strategy Automation Using Natural Language

Capitalise.ai empowers traders to automate their trading strategies using straightforward, plain-language instructions. Leveraging AI technology, users can input commands like, “Buy Apple stock if it crosses above the 200-day SMA and the VIX rises above the previous day’s close.” The platform is particularly beneficial for traders who prefer not to engage in coding their own automation tools. With Capitalise.ai, one can easily establish strategies such as dollar-cost averaging, set trailing stop losses and take profit orders, execute trades based on news events, and craft intelligent alerts, among other features. Capitalise.ai is accessible for free to users who have an account with any of its partnered brokers or exchanges, including prominent names like Interactive Brokers, Fidelity Investments, Binance, and AvaTrade, enhancing its utility and reach across various trading environments.Tickeron – Comprehensive AI Stock Trading Platform

Tickeron is an innovative platform that offers a suite of AI-powered trading tools. These tools include AI-based trend predictions, AI-generated price signals, and virtual accounts that feature automated money management options driven by artificial intelligence. Additionally, Tickeron provides an AI stock screener and a pattern recognition tool that utilizes AI to detect patterns in price charts. This makes it a versatile choice for both active and passive investors. For those inclined towards passive investment, Tickeron offers AI-managed stock portfolios that target specific sectors, such as the semiconductor or biotech industries. Beyond its AI functionalities, Tickeron fosters a community for traders where they can exchange and discuss trading strategies. The platform offers a basic free tier that includes daily trading signals. For more seasoned traders looking for enhanced capabilities, Tickeron presents various paid plans starting at $30 per month. These plans are highly customizable, allowing users to tailor their subscriptions based on the features they need most.Magnifi – Conversational AI to Guide Investment Choices

Magnifi is a sophisticated AI tool designed to assist users in making informed investment decisions. The platform serves as an “investment co-pilot,” featuring a conversational AI that users can interact with simply by asking questions. This AI responds in natural language, making it accessible and user-friendly. Magnifi’s AI is tailored to help users identify the most suitable investment style based on their preferences and objectives. Once it gauges a user’s profile, it recommends a well-diversified investment portfolio crafted to meet their specific financial goals. For users with accounts at affiliated brokers like Robinhood, Charles Schwab, and E*Trade, the Magnifi tool offers additional functionality. It can automatically review their portfolios and suggest improvements. For instance, the AI might point out an overconcentration in a particular stock or suggest more cost-effective ETFs or mutual funds, potentially leading to significant savings on fees.How to Select the Best AI Stock Trading Software

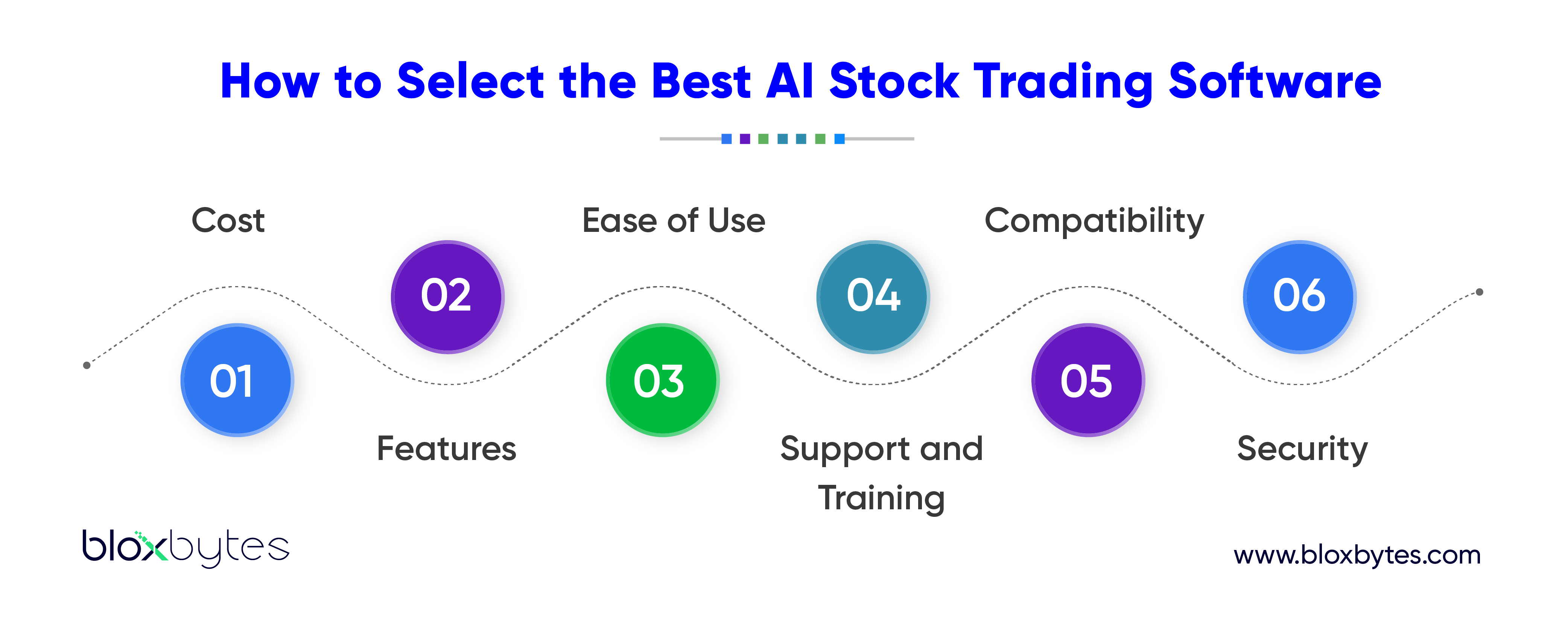

When selecting an advanced AI trading software, several factors need to be carefully considered to ensure that you choose a platform that enhances your trading performance. Key factors to consider while making this choice include: